Bonnie Kershaw stands as a testament to excellence in the accounting field, bringing over four decades of rich experience that cuts across diverse sectors, from construction to the forefront of innovation in artificial intelligence. Throughout her storied career, she has consistently observed the indispensable role that accounting plays in driving the success of businesses in every industry. Currently at BenchSci, a trailblazing AI firm revolutionizing pre-clinical pharmaceutical research, Bonnie has navigated through both familiar terrains and uncharted waters. Amidst the company’s explosive growth, which saw its size double in 2022, BenchSci faced a number of accounting challenges. One challenge included handling an overwhelming tide of expense reports. These expense reports, burdened by unwieldy spreadsheets and the painstaking process of manual data entry into accounting systems, represented a significant bottleneck in the company’s operational efficiency.

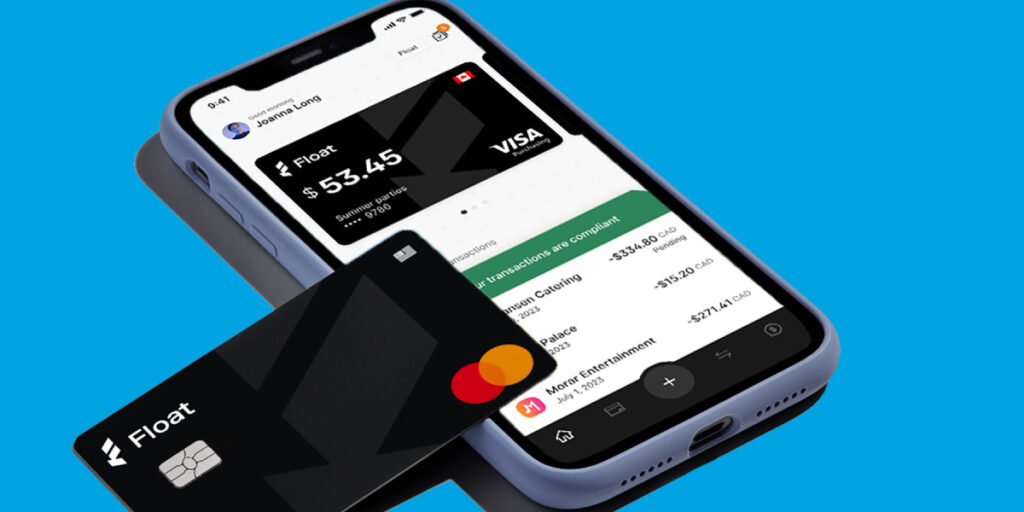

BenchSci has successfully transitioned to using Float to issue both physical and virtual cards to employees, moving away from the cumbersome and outdated expense report process. This strategic shift has resulted in a significant time saving of 40+ hours per month, streamlining expense processing and enhancing operational efficiency. This achievement is a monument to the fruitful partnership between BenchSci, and Float.

A Partner First, Customer Second

BenchSci distinguished itself not only as an early adopter of Float but also as a key partner in honing the platform’s features to better serve its needs. By actively engaging in the feedback loop, conducting thorough testing, and contributing to the feature development roadmap, BenchSci helped ensure that Float’s offerings were finely tuned to address the complexities of modern financial operations. This partnership allowed BenchSci to significantly benefit from Float’s cutting-edge capabilities, tailored to streamline and enhance its expense management processes. In turn, Float’s features evolved through this collaborative process, becoming more aligned with the practical demands of companies like BenchSci. This mutually beneficial relationship underscored the value of Float’s features in addressing the specific challenges faced by BenchSci, showcasing the platform’s adaptability and relevance in a fast-paced business environment.

From Tedious Expense Reports to Corporate Cards for All

“We wanted to alleviate the pressure of employees having to pay with their own funds and waiting for reimbursement for company expenses.”

As BenchSci underwent a period of rapid expansion, it encountered two primary challenges with its existing reimbursement approach. The first challenge was the laborious nature of expense reports for employees. The manual entry of data into Google Sheets not only consumed considerable time but also resulted in delays in delivering these reports to the finance team. Bonnie highlighted the frequent issues, stating, “A lot of times people weren’t sending their expenses in on a timely basis… because we’re remote, you’d have to go back and forth as well when information or receipts were missing.” As the company’s transaction volume increased, the process of entering expense report data into the Accounting System one at a time consumed a significant portion of Bonnie’s schedule.

The second challenge involved employees having to use their personal funds for significant company-related purchases, such as travel expenses. “We wanted to alleviate the pressure of employees having to pay with their own funds and waiting for reimbursement for company expenses,” Bonnie explained. The adoption of Float presented a solution to these challenges, offering BenchSci the ability to issue an unlimited number of physical and virtual cards. This enabled proactive control over company spending and eliminated the reliance on the cumbersome reimbursement process, significantly improving the efficiency of expense management and employee satisfaction.

A Culture of “Freedom and Responsibility”

“It’s very handy. If somebody needs a temporary increase, they can click on a button and request higher spend. We also love that people can request virtual cards for things like subscriptions.”

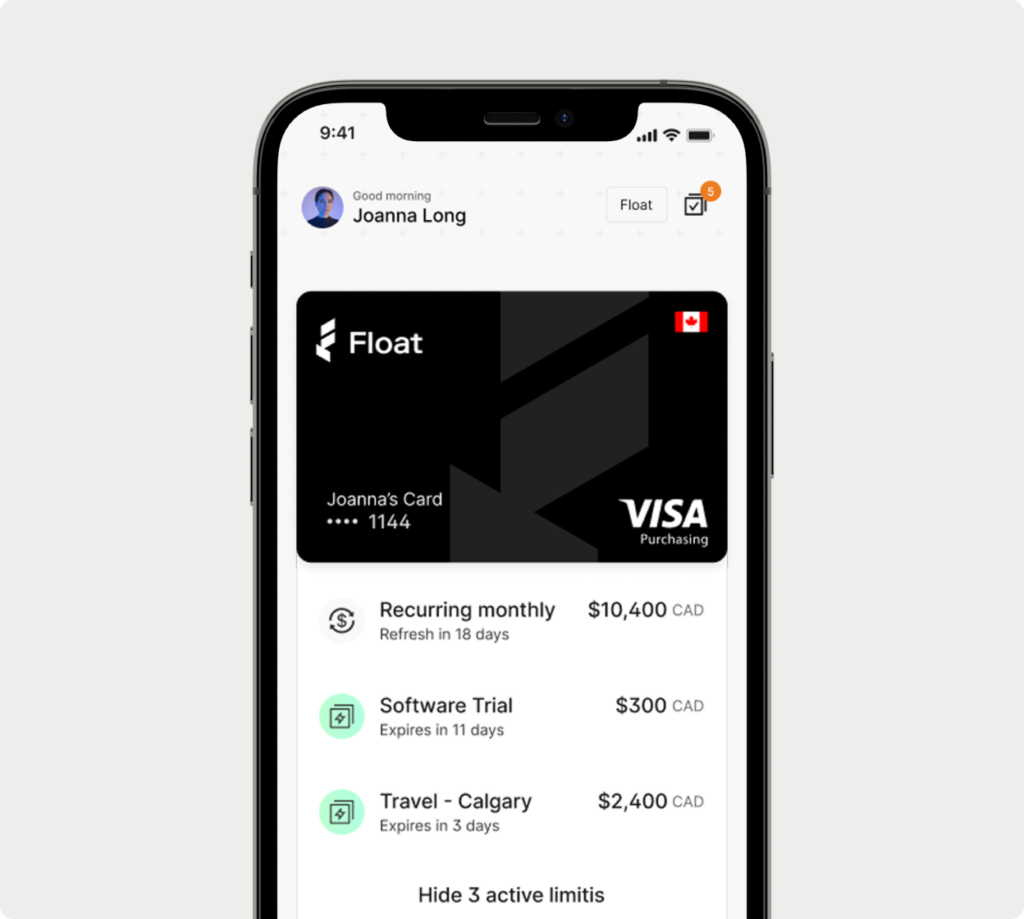

At BenchSci, fostering a culture of “Freedom and Responsibility” is a top priority. Bonnie encapsulates this philosophy, stating, “Each person is responsible for the success of the company. So you treat company money like your own personal money.” This principle guides the finance team’s use of Float to empower each employee with their own physical Float credit card, endowed with a predefined monthly renewable limit. Moreover, to enhance flexibility and autonomy regarding employee benefits, additional expense policies are implemented on these corporate cards. These policies cater to specific stipends, such as learning and development, with annual limits, thus offering employees greater freedom in utilizing their perks.

For situations where additional funds are necessary, Float simplifies the process, allowing employees to request a temporary increase in their spending limit with just a brief explanation of the intended expenditure. Bonnie appreciates the efficiency of this feature, noting, “It’s very handy. If somebody needs a temporary increase, they can click on a button and request higher spend. We also love that people can request virtual cards for things like subscriptions.” This shift has significantly empowered employees, allowing them to directly manage software subscription payments pertinent to their teams, a task that was previously handled by the finance team through ACH or wire transfers. Float’s vendor-specific virtual cards, which can be set with recurring limits and expiration dates aligned with the company’s contractual terms, further streamline this process and safeguard against unnecessary spending.

Accounting Automations: A Huge Time-Saver

“Huge time saver! The fact that we can automate transactions going from Float directly to the Accounting System makes things simple.”

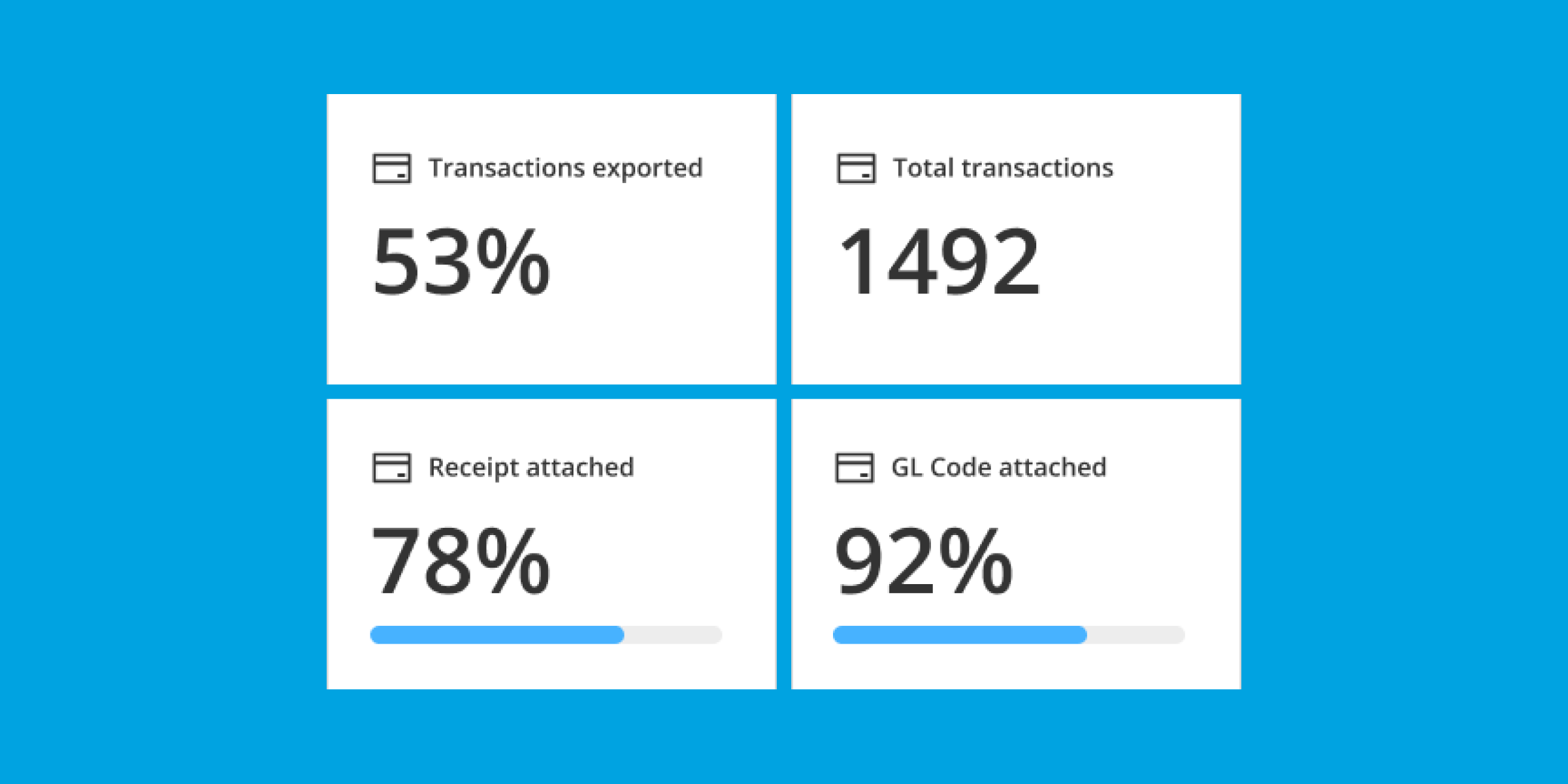

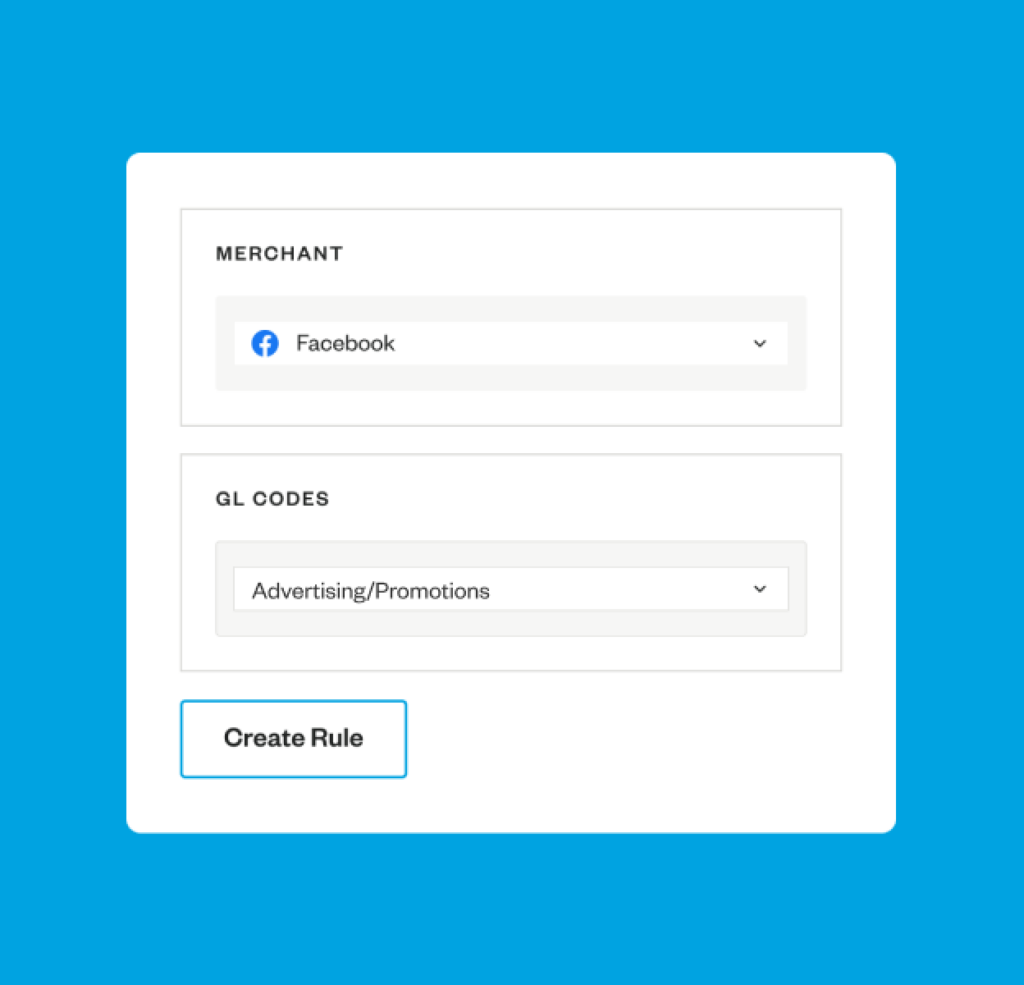

This new, proactive approach to spend reduced the need for the team’s spreadsheet expense reports (and transcribing them into the Accounting System). In addition to creating a better alternative to the manual processing of expense reports, the team unlocked further time-savings with Float’s Accounting Automations. To streamline reconciling the company’s expenses, they use Float’s Merchant Rules to automatically code all transactions made at the same vendor with the matching GL codes and tags. Employees also have the ability to add GL codes to transactions themselves as they spend, to help streamline the close process for the finance team as well.

When BenchSci’s finance team wants to review transactions before exporting to their accounting software at month-end, they can use Float’s Accounting Workboard to pull a list of non-compliant transactions in a single click. They can filter this list and make updates in bulk so all transactions are quickly ready for export. Bonnie says, “You’re proofing everything before exporting it, so you know once it gets into the Accounting System you don’t have to go check on things to make sure they’re done properly.” As Float integrates directly with their accounting software, the team can sync transactions in bulk from Float to the Accounting System in a few simple steps without worrying about downloading and manipulating data in spreadsheets. On tying Float’s Automations and Accounting Sync together, Bonnie said, “Huge time saver! The fact that we can automate transactions going from Float directly to the Accounting System makes things simple.”

Security and User Management at Scale

“Automatically on their final day their card is paused, which is amazing. I’d normally have to put a reminder in my calendar to do that, but now it’s done for me.”

With a growing team of over 350 employees, BenchSci required a spend management solution equipped with robust user management and security features to safeguard company finances. To streamline the process of employee transitions, BenchSci integrated Float with their Human Resources Information System (HRIS). This integration facilitates the automatic synchronization of employees’ names, titles, and direct managers to Float, ensuring that card activity can be efficiently managed in alignment with personnel changes. Cards are automatically paused when an employee leaves the company, significantly reducing manual effort and enhancing security. Bonnie appreciates the automated efficiency, remarking, “Automatically on their final day their card is paused, which is amazing. I’d normally have to put a reminder in my calendar to do that, but now it’s done for me.”

To further secure and simplify access to Float, BenchSci utilizes the single sign-on (SSO) solution provided by Okta. This allows IT to distribute a single set of secure login credentials to employees, which can be used across the company’s diverse platforms, including Float. This approach not only streamlines the login process for employees, enhancing user experience, but also maintains a high level of security across all company-sanctioned software and applications, ensuring that access to sensitive financial management tools like Float is both secure and efficient.

Supercharging The Finance Team’s Efficiency

“The Accounting Automations are the biggest Float features for me. There’s also other features – being able to control spending limits, submission policies, approval workflows… They’re all great audit controls.”

Transitioning from an era dominated by paper-based processes, Bonnie has witnessed firsthand the transformative impact of technology on accounting and expense management.

Reflecting on the advancements that solutions like Float represent, Bonnie says, “I can’t even imagine going backwards to that old time when we had to do things manually. I look back and think why didn’t someone create this 20 years ago? It would have definitely been well received by accountants, especially someone in my position who is the one doing work on the ground level.”

Bonnie leveraged Float’s suite of accounting features to not only work more efficiently but also to enhance the company’s control of employee spend. “The Accounting Automations are the biggest Float features for me. There’s also other features – being able to control spending limits, submission policies, approval workflows… They’re all great audit controls.”

Revolutionizing Financial Operations

“Without Float, we’d be in the position of needing to expand our team. Thinking about the sheer volume of time saved, we’re talking a monumental 40 hours every month at the very least.”

The adoption of Float’s pioneering expense management software has revolutionized BenchSci’s financial operations, delivering unprecedented time savings each month. This transformation has empowered BenchSci’s finance team to elevate their focus to higher-value activities, underscoring their role in driving the company’s efficiency and strategic financial planning. Bonnie’s adept navigation through Float’s capabilities showcases not just her expertise but also her commitment to optimizing the finance team’s workflow, maintaining its agility and precision. Bonnie’s enthusiasm for Float’s impact is palpable: “Without Float, we’d be in the position of needing to expand our team. Thinking about the sheer volume of time saved, we’re talking a monumental 40 hours every month at the very least.” This testament not only celebrates Float’s innovative solution but also highlights Bonnie’s pivotal role in harnessing technology to forge a leaner, more dynamic finance operation at BenchSci, making it clear that with Float, the future of expense management is here, and it’s transformative.

About BenchSci

BenchSci’s vision is to exponentially increase the speed and quality of life-saving research by empowering scientists with the world’s most advanced biomedical artificial intelligence. You can find them at benchsci.com.