Guides

Guide to Modern Expense Policies

Learn how Float can help you create and implement expense policies that stick

July 26, 2022

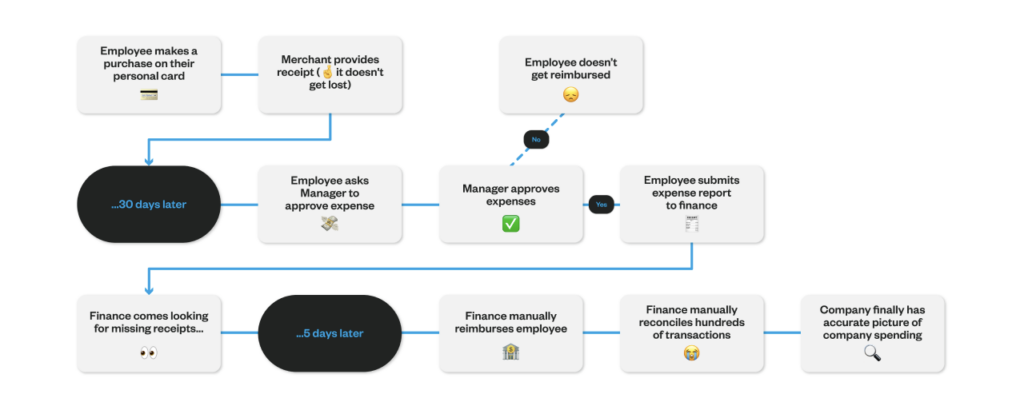

More often than not, company expenses are handled in a reactive way.

Employees will make a business purchase using personal funds, submit the necessary information to get it approved by finance, and later get reimbursed via payroll. That’s a lot of administrative overhead (and delayed financials).

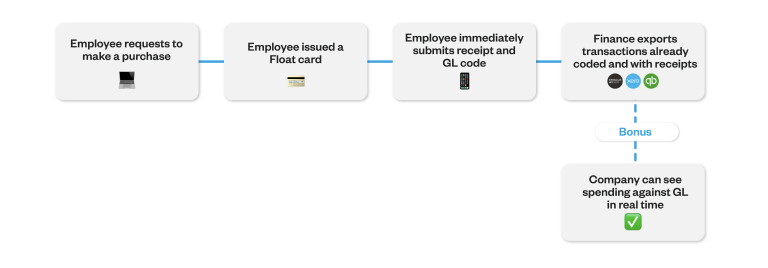

But you can make life a lot simpler by replacing this reactive approach to company spending with a faster, more proactive one.

With Float, finance teams can issue cards to employees worry-free with $0 card balances and custom limits, and automate company expense policies while gaining full visibility and control over spending.

But first…

What is an expense policy?

An expense policy is a set of guidelines made by a company that clearly identifies acceptable and unacceptable business expenses and the processes for getting them approved and reimbursed. This gives the finance department and administrators the ability to quickly determine the validity of an expense, and gives company spenders a clear understanding of what they can spend on.

Benefits of having expense policies

Expense policies offer a structured and logical way to control company-wide spending. That way, when an expense is rejected or questioned, your expense policy will serve as the final standard for making decisions on approving or rejecting the spend request.

It standardizes the rules for your expense management process, while also helping to prevent non-compliant expenses from being made. It also gives your finance team a gold standard to govern those incoming spend requests and quickly determine what’s acceptable and what’s not.

With everyone aligned on the company spending guidelines, senior management is better able to control costs more efficiently and calculate spending forecasts.

Types of expense policies

Depending on the size of your business and the industry you’re in, your expense policy will differ.

Some companies may have one broad expense policy and others may have multiple expense policies specifically related to travel, entertainment, or departmental expenses.

Typically an expense policy will include:

- Expense Categories: Different types of expenses that employees can incur, like travel, meals, accommodation, or office supplies.

- Spending Limits: Clear limits for each expense category, specifying the maximum amount employees can spend without additional approvals.

- Approval Process: The steps employees must follow to obtain approval before incurring expenses, including any documentation required.

- Documentation Requirements: The supporting documents, such as receipts or invoices, that employees need to submit along with their expense reports.

- Reimbursement Procedures: How employees should submit expense reports, including the required forms or software systems.

- Non-Reimbursable Expenses: Expenses that are not eligible for reimbursement, such as personal expenses, fines, or alcohol.

- Travel and Accommodation Guidelines: Guidelines for booking flights, hotels, and rental cars, including preferred vendors and any travel-related policies.

- Expense Audit and Compliance: The process of auditing expense reports and the consequences of non-compliance with the policy.

What’s the downside?

Having guidelines in place is essential to maintain control over employee spending. But more often than not, expense policies become corporate documents buried in a shared drive, which leads to:

- Complicated and time consuming approval processes

- Purchases being made that are not compliant with policy

- Limited visibility into spending

- High administrative overhead on reimbursements and reconciliations

- Teams being limited in making purchases necessary to help grow the business

The good news is that Float allows you to implement your company’s spend guidelines directly on Float Cards themselves – ensuring that purchases made on Float Cards are automatically compliant with your company’s expense policies.

Automated expense policies in Float

Float allows you to set boundaries for corporate spending directly on Float Cards themselves, with automated rules for transactions that reflect your company’s expense guidelines.

So every time a company employee makes a purchase on a Float Card, our intelligent software will determine if the transaction complies and automatically prompt cardholders to upload receipts and expense information as soon as a transaction is made.

Contrary to traditional teams where only a limited few hold business credit cards (and share them), Float allows company’s to issue Float Cards to all team members, worry-free, with real-time visibility and control over company-wide spend.

Here’s how:

✅ Approve spend before it happens

Multi-level Approval policies based on your company’s organization structure lets employees easily request to make a purchase from managers (with an audit trail).

🤖 Automatically collect receipts and GL codes

Submission Policies let you define the information employees are required to submit with each transaction, like receipts and GL codes, and will pause cards without them.

🛡️ Protect your company from unauthorized spend

Individual card controls like Merchant Controls let you restrict spending at certain merchant categories and custom Recurring and Temporary limits ensure your company doesn’t get overcharged.

📉 Get insights into your cash flow

Float’s Reporting feature provides a real-time overview of company spending with insights into who is spending what.

—

Want to learn more about Canada’s smartest corporate cards and business spend software? Get our Spend Management Guide at the link below.

Login to Float to implement your company’s expense policies, or Book a demo today to experience simplified business spending.

Written by

All the resources

Case Studies

How BenchSci Saved 40+ Hours a Month Streamlining Spend Management with Float

Trailblazing AI firm, BenchSci shares why they chose Float for secure spend management at scale.

Read More

Case Studies

Health and Wellness SaaS Company Practice Better Closes the Books 6x Faster with Float

How the growing startup Practice Better leveraged Float to bring their spend management and bookkeeping in-house.

Read More

Case Studies

Creative Production Company Makers Chooses Float to Scale Spend Management

Makers shares how they cut their time spent reconciling transactions in half while empowering spend across the company’s project teams.

Read More