Building business credit in Canada is crucial for entrepreneurs looking to grow their ventures. Whether you’re a startup or an established company, a strong corporate credit score can open doors to better financing options and business opportunities.

What is business credit?

It’s when a business is able to purchase goods and services and pay for them at a later date. You can build business credit over time by maintaining a solid track record of financial wellness in your company. When you have a strong credit rating, it becomes easier for a company to borrow money when they need it.

Why Business Credit Matters?

Building business credit is crucial for several reasons, supported by concrete statistics that highlight its impact on business operations and growth:

- Access to Funding: A strong business credit profile significantly improves a company’s chances of obtaining financing. According to the U.S. Small Business Administration (SBA), 27% of businesses reported they could not receive the funding they needed, which can be detrimental to growth and sustainability (SBA.gov). Businesses with established credit are 41% more likely to be approved for bank loans (Nav).

- Cost Savings: Good business credit can lead to lower interest rates on loans and better terms with suppliers. This translates to substantial savings over time. For instance, businesses with strong credit ratings often receive lower interest rates on loans, which can save thousands of dollars annually compared to those with weaker credit profiles (Nav).

- Cash Flow Management: Effective cash flow management is directly linked to business credit. Businesses that manage their cash flow well can maintain on-time payments, positively impacting their credit scores. Late payments can hurt credit scores, making it harder and more expensive to obtain credit in the future (Nav).

- Growth Opportunities: Access to credit allows businesses to invest in expansion opportunities. Whether it’s hiring more staff, purchasing inventory, or expanding facilities, credit availability can be a crucial factor in supporting business growth. According to Nav, nearly 73% of small firms used financing in the past 12 months to support their operations and growth (Nav).

- Business Survival and Success: Statistics show that businesses with better access to credit have higher survival rates. The SBA notes that almost 80% of businesses that started in 2014 survived until 2015, highlighting the importance of financial stability in the early stages (Nav).

By understanding and building business credit, companies can ensure they have the financial resources needed to support operations, manage cash flow effectively, and seize growth opportunities. For more detailed information, you can refer to resources from the U.S. Small Business Administration and Nav.

Steps to Build Business Credit in Canada

1. Establish Your Business Structure

To start building business credit, you need a proper business structure:

- Register your business

- Get a business number from the CRA

- Open a business bank account

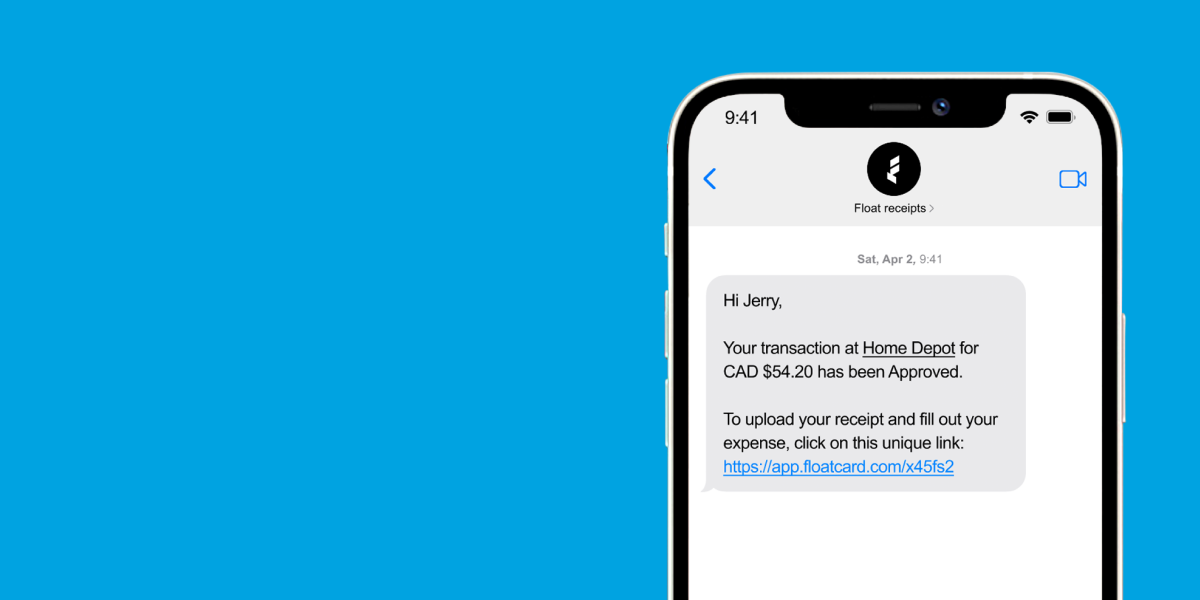

2. Apply for a Business Credit Card like Float

A business credit card is often the first step in establishing a credit history:

- Choose a card that reports to business credit bureaus

- Use it regularly for business expenses

- Pay the balance in full each month

3. Work with Suppliers and Vendors

Building relationships with suppliers can help improve your business credit:

- Set up trade credit accounts

- Pay invoices on time or early

- Ask suppliers to report your payments to credit bureaus

4. Monitor Your Business Credit Score

Keeping an eye on your corporate credit score is crucial:

- Check your score regularly

- Dispute any errors promptly

- Understand what factors influence your score

5. Maintain Good Financial Habits

Consistency is key when it comes to improving business credit:

- Pay all bills on time

- Keep debt levels low

- Maintain a positive cash flow

Common Mistakes to Avoid

When building business credit in Canada, steer clear of these pitfalls:

- Mixing personal and business finances

- Applying for too much credit too quickly

- Ignoring errors on your credit report

FAQs

Q: How long does it take to build business credit in Canada? A: It typically takes 2-3 years to establish a solid business credit history.

Q: Can I build business credit without a business credit card? A: Yes, through trade credit with suppliers and other forms of business loans.

Q: How often should I check my business credit score? A: It’s recommended to check your score at least quarterly.

Q: Does my personal credit affect my business credit? A: For new businesses, personal credit may be considered, but established businesses are evaluated separately.

Q: If getting credit is so hard for a business, why not use your personal card? A: As a small business owner, separating your business credit from personal credit is key. When you use your personal card for business purchases, you’re actually missing out on an opportunity to build business credit. 💳 It also blurs the lines between business and personal expenses, which can be a big headache for your finance team during tax season.

In Conclusion: Building Business Credit is Important

Building business credit in Canada takes time and effort, but the benefits are well worth it. By following these steps and maintaining good financial habits, you can improve your business credit score and open up new opportunities for your company’s growth and success.

—

Float is Canada’s only all-in-one corporate cards, reimbursements, and bill pay platform that helps customers:

- Earn cashback on all categories of spend and save on FX

- Generate 4% interest on funds held with Float

- Eliminate expense reports and receipt chasing

- Close the books 5x faster at the month-end

Want to learn how companies like Clutch, Neo, Knix, and 1,000s of other Canadian businesses on average save 7% of their monthly spend with Float? Get started with Float today by clicking the button below!

Want to learn more before singing up? Book a demo today to learn more about the product from our team!