Two years ago, Float officially launched with a big, bold mission to simplify spend for Canadian companies and teams.

Since then we’ve helped thousands of finance teams take control over their spending while saving millions of hours in receipt collection and reconciliations.

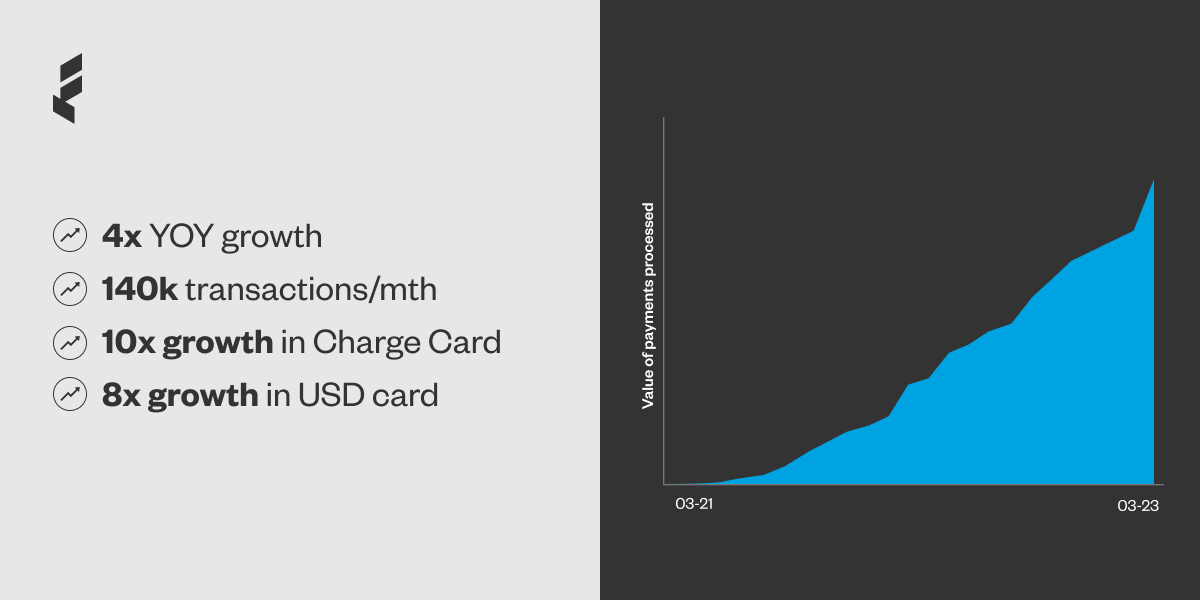

As a result of providing this value, we grew revenue 4x over the past year, and over 100x since our very first month in business. We went from serving startups to a cross section of the Canadian economy, with customers now processing over 140,000 monthly transactions through Float.

Here are a few Float milestones from the last year:

New payment solutions with the launch of Float USD and Charge Card products

Since Float’s inception, USD cards have been the number one product requested by our customers. Many were frustrated by the offerings (or lack thereof) from Canada’s big banks, as most require a US legal entity, and none offer the advanced spend management tools that Float has become known for.

The response to our USD Cards has been phenomenal, resulting in a 5x increase in customers and 8x increase in transaction volume since launch. USD has become a core part of Float’s business, accounting for close to 20% of total spend.

Float’s Charge Card launched in summer 2022, offering extremely high limits compared to alternatives, with no interest or fees. Similar to our USD Cards, our Charge Card product has experienced exceptional takeup with 7x customer growth and 10x payment volume growth since its introduction.

Spend controls that lower risk while increasing productivity

The economic climate of the last year has underlined how critical it is for companies to have tight control over all spending. We help finance leaders by giving them real time visibility into spending across their business, and advanced controls that lower the risk of issuing cards to employees.

Merchant Controls give finance teams the ability to restrict card spending by merchant category.

Float’s Expense Policy gives teams the ability to implement company expense policies directly in Float, from defining the transaction information that employees are required to submit, to assigning multiple approval layers for employee spend requests within an organization.

Audit Logs that enable admins to easily view and export a history of cardcreation, changes, pauses, expiration, and deletion for all their Float cards to date.

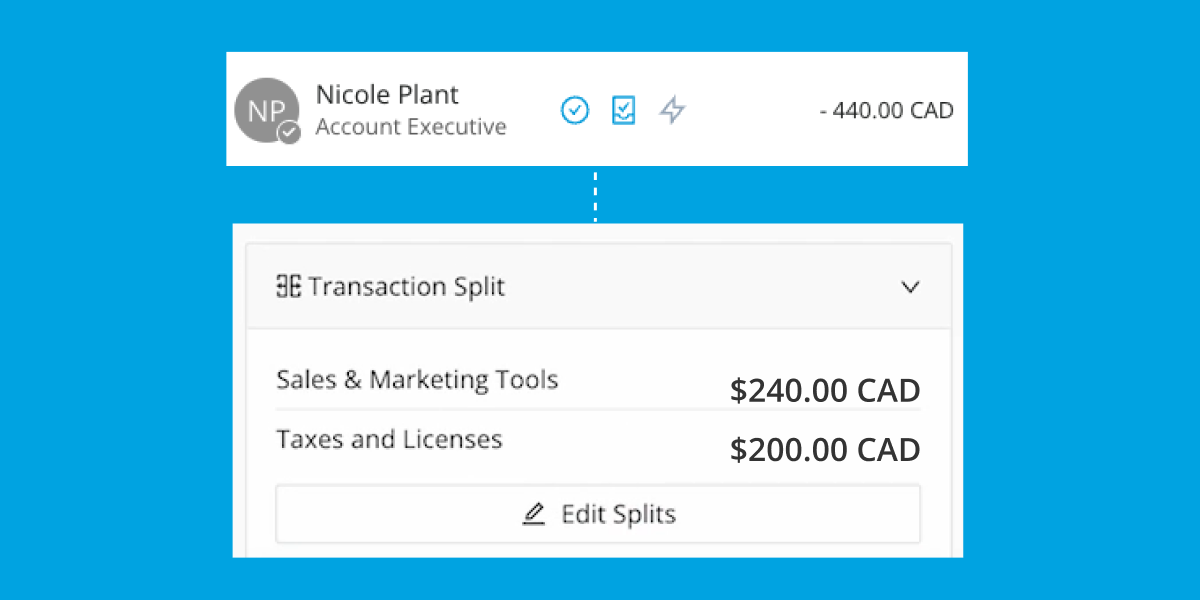

Powerful accounting automations that save thousands of hours

Every other functional team has benefited from digital transformation and modernization. Float’s spend management solution does this for the finance function.

We shipped new automations and enhancements that save thousands of hours in manual accounting tasks, including:

- Automated receipt matching

- Personalized receipt forwarding

- Suggested GL codes

Customers have shared that with Float, month-end is much faster, they can now do continuous closes, and they can scale the finance function without having to add additional overhead.

“Float saves the accounting team countless precious hours at month end. This will allow the team to refocus on more value-add activities like analysis of the spend rather than spending hours on data aggregation.”

Benjamin Koppeser, Senior Manager, Finance, Clutch

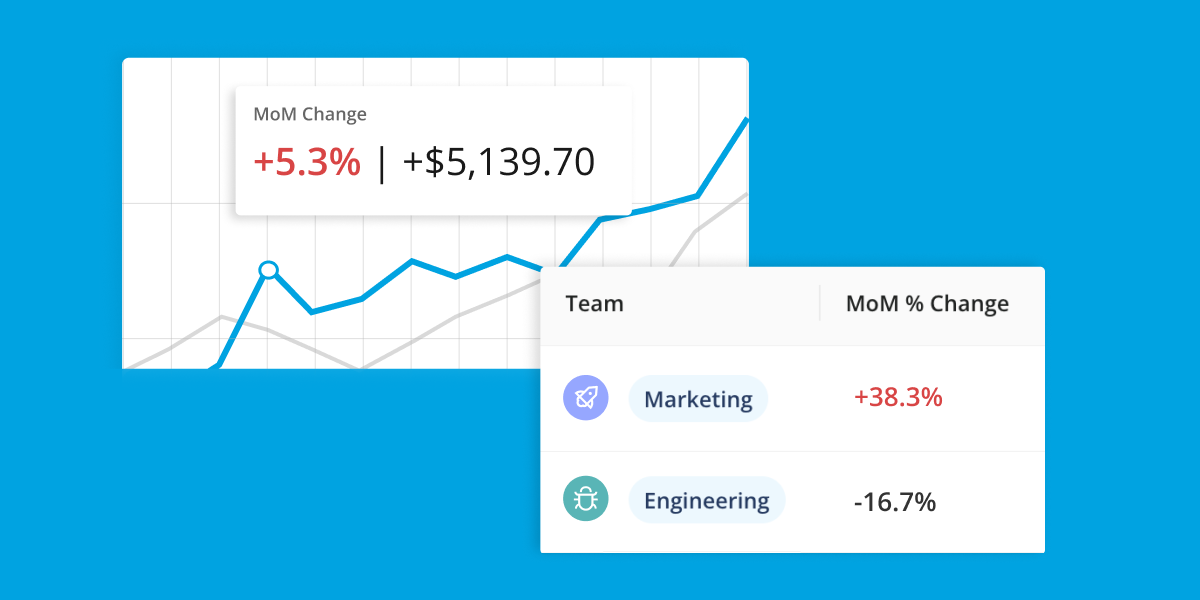

Real-time reporting that helps teams find savings

We heard from customers that traditional providers made it difficult to have real-time visibility over spend, and no reporting capabilities to easily spot concerning trends.

With that in mind, Float launched our new Reporting functionality in close collaboration with our largest customers, a feature that is being used weekly by the majority of our customers.

Float customers can see a snapshot of company spending and be able to analyze trends over time. With financial data visualizations of both CAD and USD spending, they can view month-to-date spending and quickly identify increases or decreases in spending patterns.

Admins can also run custom spend reports by merchant, vendor, GL code, category, cardholder, team, or tag to get a more detailed understanding of where company money is going. This level of insight can help finance teams identify areas of overspending or opportunities for cost savings.

“In the past I was reviewing the spending daily to spot any anomalies or large spends that required further analysis. We were not following up at month end to look at any trends or patterns in the spending by customer or by buyer. My team can now analyze company spending quickly and easily. It adds another check and balance to our arsenal that we didn’t have before.”

Gino Cacciatore, CFO, Skybox Labs

Serving the needs of larger, more complex organizations

As Float’s customers grow, so do the needs of their finance team. Over the last 12 months, we introduced new functionality to better serve these larger midmarket customers.

SSO + SAML enables Single Sign-On (SSO) and provides increased security and convenience for companies by allowing for just one set of secure login credentials across platforms, including Float. SAML works by passing information about users, logins, and attributes between the service providers and identity providers (iDp) including Azure, Okta, Auth0, and OneLogin.

MFA works to improve account security and prevent unauthorized login attempts by requiring an additional “factor” to verify that the person logging in is really who they say they are. This can include a text message with a unique code or a one-time-password (OTP) issued by a third party authenticator app such as Google Authenticator.

Float’s NetSuite integration gives admins the ability to set rules to automatically code transactions with GL Codes, Vendors, Departments, Classes, Tax Codes & Locations, as well as export them to NetSuite with embedded receipts.

The modern day finance tech stack

It’s never been a more exciting time to build a company and products that serve Canadian finance teams. People across every level of finance are eager to bring modernization, automation and new solutions to the way they work.

We are grateful to serve the most innovative and respected teams in Canada and we are excited to continue on this journey.