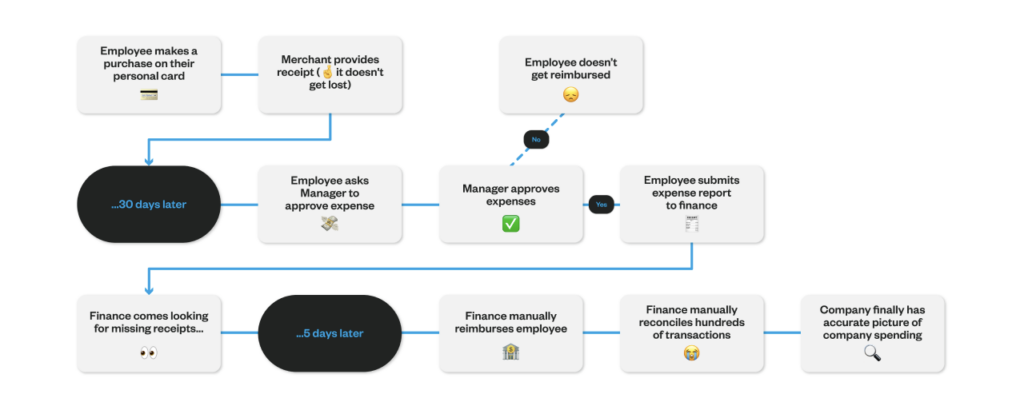

More often than not, company expense policies have not evolved. Employees will make a business purchase using personal funds, submit the necessary information to get it approved by finance, and later get reimbursed via payroll. That’s a lot of administrative overhead (and delayed financials). That’s why we’ve put together this Guide to a Modern Expense Policy.

With Float, finance teams can modernize their expense policy and become more proactive about their spending. But first…

What is an expense policy?

An expense policy is a set of guidelines that clearly defines:

- Acceptable and unacceptable business expenses

- Processes for expense approval and reimbursement

This framework helps finance departments quickly validate expenses and gives employees a clear understanding of permissible spending.

Benefits of having expense policies

Implementing an expense policy offers numerous advantages:

- Provides a structured approach to control company-wide spending

- Standardizes rules for expense management

- Prevents non-compliant expenses

- Assists finance teams in efficiently evaluating spend requests

- Enables senior management to control costs and forecast spending accurately

With everyone aligned on the company spending guidelines, senior management is better able to control costs more efficiently and calculate spending forecasts.

Types of Expense Policies

Expense policies can vary based on company size and industry. Some businesses opt for a broad, all-encompassing policy, while others create specific policies for:

- Travel

- Entertainment

- Departmental expenses

Key Components of an Expense Policy

A comprehensive expense policy typically includes:

- Expense Categories: Different types of expenses that employees can incur, like travel, meals, accommodation, or office supplies.

- Spending Limits: Clear limits for each expense category, specifying the maximum amount employees can spend without additional approvals.

- Approval Process: The steps employees must follow to obtain approval before incurring expenses, including any documentation required.

- Documentation Requirements: The supporting documents, such as receipts or invoices, that employees need to submit along with their expense reports.

- Reimbursement Procedures: How employees should submit expense reports, including the required forms or software systems.

- Non-Reimbursable Expenses: Expenses that are not eligible for reimbursement, such as personal expenses, fines, or alcohol.

- Travel and Accommodation Guidelines: Guidelines for booking flights, hotels, and rental cars, including preferred vendors and any travel-related policies.

- Expense Audit and Compliance: The process of auditing expense reports and the consequences of non-compliance with the policy.

What’s the downside?

While essential, traditional expense policies can lead to challenges.

High administrative overhead

Recent industry research reveals startling figures about corporate expense management:

- Typical businesses handle over 50,000 expense reports annually

- The cost of processing these reports can exceed $500,000 per year

- Companies spend around 3,000 hours yearly fixing errors in expense reports

- Correcting a single expense report costs an additional $50+ on average

A different US-based research from the Aberdeen Group shared these eye-opening statistics:

- Nearly one in five expense reports contain errors or missing information

- For small businesses, the average time to approve an expense report is over a week

- About a quarter of expense reports don’t comply with company policies

- Almost half of small businesses lack clear procedures for handling non-compliant expenses

These figures highlight a pressing need for improvement in expense management processes. As a business owner, you’d likely address any other system with such a high failure rate immediately. It’s time to give expense management the same attention and upgrade it for better efficiency and accuracy.

Employee Dissatisfaction and Frustration

Recent research by Allstar Business Solutions reveals alarming trends in employee expense claiming habits.

- According to the study, over a third of workers never claim back expenses, with 58% avoiding claims under £5 (SmallBusiness.co.uk, 2018).

- The survey of 2,001 British workers uncovered significant gender disparities, with women claiming less than half the amount men do on average.

- Furthermore, 25% of employees have postponed or cancelled meetings to avoid out-of-pocket expenses, while 64% describe the claiming process as frustrating.

These findings highlight the urgent need for businesses to streamline their expense management processes, as inefficient systems not only impact employee satisfaction but can also hinder business growth by discouraging necessary expenditures.

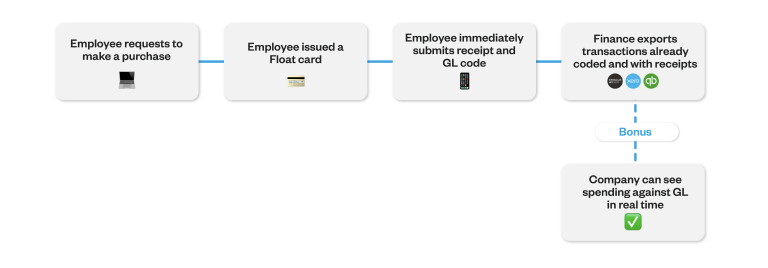

The Future of Expense Policies: Automated Solutions with Float

Enter Float – a revolutionary solution that automates expense policy implementation. With Float, you can:

- Set spending boundaries directly on company cards

- Ensure automatic compliance with company guidelines

- Prompt cardholders to upload receipts and expense information in real-time

- Issue cards to all team members without worry

- Gain real-time visibility and control over company-wide spending

Here’s how:

✅ Approve spend before it happens

Multi-level Approval policies based on your company’s organization structure lets employees easily request to make a purchase from managers (with an audit trail).

🤖 Automatically collect receipts and GL codes

Submission Policies let you define the information employees are required to submit with each transaction, like receipts and GL codes, and will pause cards without them.

🛡️ Protect your company from unauthorized spend

Individual card controls like Merchant Controls let you restrict spending at certain merchant categories and custom Recurring and Temporary limits ensure your company doesn’t get overcharged.

📉 Get insights into your cash flow

Float’s Reporting feature provides a real-time overview of company spending with insights into who is spending what.

Conclusion: Revolutionize Your Expense Management

Don’t let outdated expense policies hold your business back. Embrace the future of expense management with automated solutions like Float. By implementing smart, efficient expense policies, you can take control of your company’s spending while fostering growth and innovation.

—

Want to learn more about Canada’s smartest corporate cards and business spend software? Get our Spend Management Guide at the link below.

Login to Float to implement your company’s expense policies, or Book a demo today to experience simplified business spending.