Forma.ai, the world’s first end-to-end sales performance management (SPM) platform, is growing and they’re growing fast. Andy O’Reilly, Forma.ai’s Senior Manager of Finance & Technology, swiftly recognized after joining the company in 2021 that a quick and efficient spend management solution was necessary. With the company’s headcount increasing 4x in a little over a year, Float was the obvious solution to help manage spending and track expenses. Read how Float has enabled Andy and the entire Forma.ai team to reach their goals and maintain their rapid growth without the distractions of over-complex and manual spend management processes.

Q1: How long have you been using Float? What about Float made you choose us?

I joined Forma.ai in March 2021 and coincidentally, in April 2021, one month after I joined, Float reached out to us and we’ve been working together ever since. Given the nature of my job, I see a lot of demos – but Float’s was one of the best I’ve seen. I felt immediate confidence in the platform and in their level of service and attention. I also quickly saw that Float was able to offer our teams the financial autonomy and agility we were searching for, while maintaining full control of budgetary spend. At the time of onboarding, I was a team of one and we were a company of 50 employees. Checking expenses against receipts was a huge bottleneck for everyone. We’re over 150 employees now and without Float we would have had an A/P nightmare.

Float has created an independent workflow where everything is automated, integrated, and digitally captured – allowing us to focus all our attention on taking Forma.ai to the next level of our growth.

Q2: What did company spending and expense management look like before Float?

Before Float, spend and expense management was tedious and time-consuming. We did not have an efficient system in place or a way to track expenses. We had one credit card and often had to facilitate wire transfers, which cost us money every time!

Working with Float, we’ve been able to save so much money and become more streamlined at the same time. AND we get back what we spend on our Float cards with their cashback feature – it’s a win-win!

Float also gives me the power to manage and oversee everything without having to be directly involved. Our senior leadership team can now control their own spending and expenses without constantly seeking approval to use their corporate cards. It not only makes my life easier but for our whole team too!

We recently raised $45 million in our Series B funding round, which is a big milestone for the company. Given our tremendous growth in the last year, I don’t think it would have been possible to get to where we are today without Float.

Q3: What were the biggest pain points that Float solved for your business?

Before using Float, we had a single corporate card that a lot of people needed to access. We have a large sales team distributed across Canada and the United States – just imagine the receipt tracking that came with that!

I really value how much Float has streamlined our bookkeeping. It integrates so well with our accounting software and the process of balancing our books is no longer manual.

Float also sends every employee a notification after a transaction has been completed, reminding them to take a picture of their receipt and upload it. It’s now so much easier to get a handle on our receipt paper trail because it’s all stored in the cloud.

Q4: What is the best part of working with Float?

Float’s ability to integrate has been a game-changer for us at Forma.ai. The automation gives us back so much time we otherwise wouldn’t have had. It has also created a smooth expense approval workflow, with no hold-ups or delays in reimbursement.

With Float, we can easily set financial or time limits on cards and having this control gives everyone clear guidelines and expectations when it comes to company spending.

Since implementing Float at Forma.ai, I’ve recommended the product to several colleagues in the industry. The Float team is always available and attentive, supporting us with whatever we need. The direct chat has allowed for seamless communication and no mixed messages.

Aside from the people, the Float platform is critical for us now. Float’s virtual cards continue to give our team the flexibility and autonomy they need and deserve – we have a total of 60 currently active. If one of our team members leaves, we can immediately stop their card without having to worry about cancelling any of their subscriptions or memberships.

About Forma.ai

Forma.ai is the only sales compensation platform that allows organizations to flexibly manage what are currently brittle and easily broken sales compensation management processes. Their unique platform enables organizations to design, execute, and optimize their sales compensation strategy with a scientific approach driven by a collective data model. Forma.ai transforms one of the largest cost centers in an organization into its most powerful lever for top-line revenue growth. Founded in Toronto in 2016, the company is backed by ACME Capital, Crosslink Capital, xFund, Panache Ventures, Golden Ventures, Uncork Capital and Gaingels. Forma.ai is trusted by a growing list of innovative global enterprises with clients including Autodesk, TrustPilot, OpenTable, CareerBuilder, and more.

About Float

—

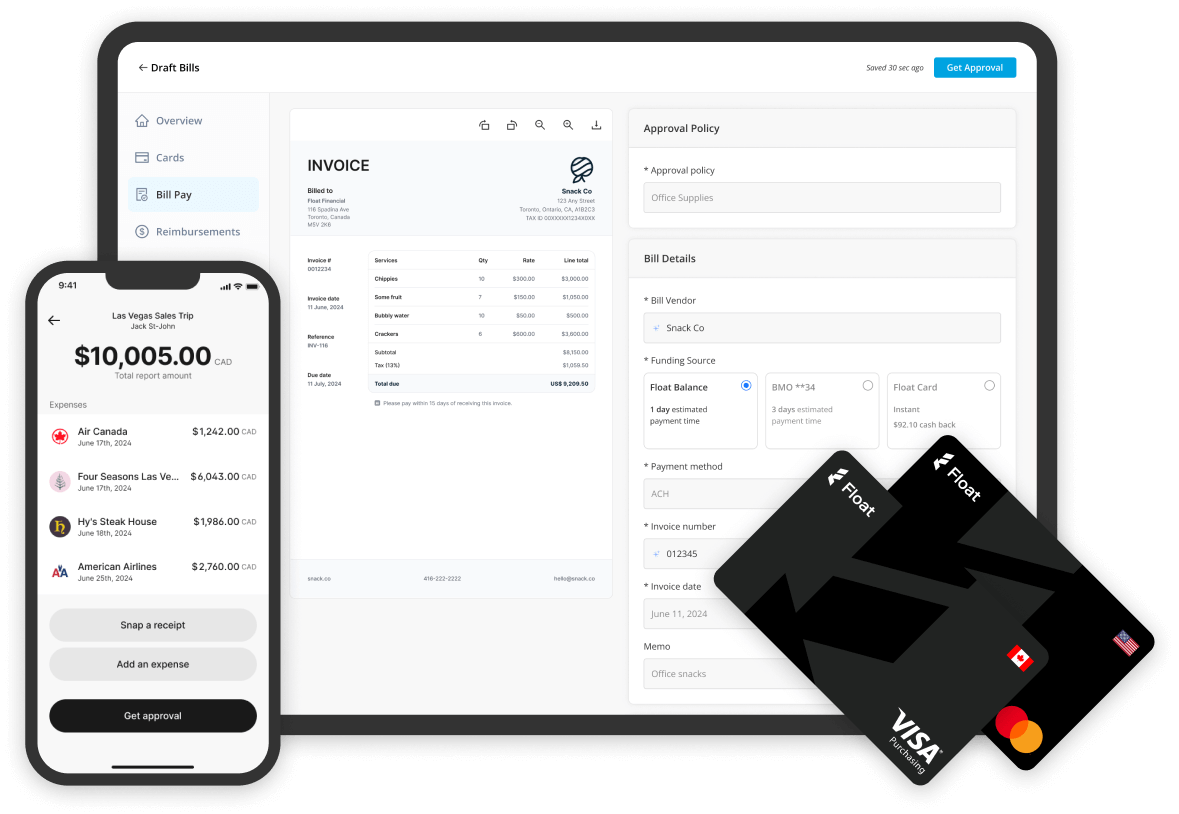

Float is Canada’s only all-in-one corporate cards, reimbursements, and bill pay platform that helps customers:

- Earn cashback on all categories of spend and save on FX

- Generate 4% interest on funds held with Float

- Eliminate expense reports and receipt chasing

- Close the books 5x faster at the month-end

Want to learn how companies like Clutch, Neo, Knix, and 1,000s of other Canadian businesses on average save 7% of their monthly spend with Float? Get started with Float today by clicking the button below!

Want to learn more before singing up? Book a demo today to learn more about the product from our team!