Looking to sharpen your bookkeeping skills without breaking the bank? We’ve rounded up 5 free online bookkeeping courses online that’ll help Canadian small businesses owners and finance teams.

Why Bother with Courses on Bookkeeping?

Let’s face it, training in bookkeeping isn’t the most thrilling part of running a business. But it’s crucial for:

- Keeping your financial records in order

- Making tax time less of a headache

- Understanding your company’s financial health

- Making smarter business decisions

So, let’s dive into these free online bookkeeping courses that’ll transform you from a numbers novice to a balance sheet boss!

Introduction to Bookkeeping and Accounting

Are you keen to grasp the essentials of bookkeeping and online accounting? The Open University offers a fantastic free online bookkeeping course that’ll set you on the path to financial wizardry.

Introduction to Bookkeeping and Accounting is a gem for anyone looking to:

- Master the numerical skills crucial for bookkeeping

- Understand the accounting equation and double-entry bookkeeping

- Learn how to record transactions like a pro

- Create balance sheets and profit & loss accounts

This course is completely free and self-paced. You can learn at your own speed, fitting it around your own schedule.

What’s included:

- 8 hours of study material

- Beginner level content

- A free statement of participation upon completion

- Option to earn a digital badge

Whether you’re a small business owner wanting to get a handle on your finances, or you’re considering a career change into accounting, this course provides a solid foundation.

Head over to The Open University’s website and create your free account. Your journey into the world of bookkeeping starts now!

Free Online Payroll Course: Master the Basics of Bookkeeping

Are you a small business owner or aspiring bookkeeper looking to get a handle on payroll accounting? Look no further! FreeBookkeepingAccounting.com offers a fantastic free online payroll course that’ll have you crunching numbers like a pro in no time.

This course covers all the essentials:

- The complete payroll process

- Understanding wages journals

- Fundamentals of payroll accounting

- And much more!

No registration required – simply scroll down and start learning at your own pace. Perfect for beginners, this course breaks down complex concepts into bite-sized, easy-to-digest modules.

Key topics include:

- Decoding payslips and key payroll terms

- The five main steps of the payroll process

- Creating and understanding wages journals

- Accounting for deductions and employer costs

Whether you’re looking to handle payroll for your own business or kickstart a career in bookkeeping, this free course is an excellent starting point. It’s packed with practical knowledge, clear explanations, and even includes visuals to illustrate key concepts.

ACCA’s Free Online Courses

ACCA (Association of Chartered Certified Accountants) is a globally respected body for professional accountants. They’re offering a treasure trove of knowledge to help you level up your career.

Here’s what’s on offer:

- Dive into the world of Machine Learning for Finance

- Master the basics with Financial Accounting and Management Accounting courses

- Get tech-savvy with Robotic Process Automation and Cybersecurity for finance pros

- Build a solid foundation with Intro to Bookkeeping and Management Accounting

The best part? These courses are completely free to audit, with the option to earn a verified bookkeeping certificate for a small fee if you want to showcase your new skills.

Intuit Academy Bookkeeping Professional Certificate

Are you looking to dive into the world of bookkeeping or level up your financial skills? Look no further than the Intuit Academy Bookkeeping Online Professional Certificate offered on Coursera! This comprehensive program is designed for beginners and career-changers alike.

Here’s why it’s worth your time:

- No prior experience needed – start from scratch and build a solid foundation

- Learn from industry experts at Intuit

- Flexible, self-paced learning – complete in about 2 months at 10 hours per week

- Earn a respected credential to showcase on your LinkedIn profile and resume

What You’ll Learn:

- Essential bookkeeping concepts and accounting principles

- Navigating the accounting cycle to produce financial statements

- Analyzing financial data to make smart business decisions

- Hands-on practice with real-world scenarios

While this course isn’t free, you can always apply for financial aid with Coursera. This bookkeeping program is included with a Coursera Plus subscription, making it an incredibly cost-effective way to invest in your future.

FAQ: Your Burning Bookkeeping Questions Answered

Q: Do I need any prior experience to take these courses? A: Most of these courses are designed for beginners, but check the individual descriptions for any prerequisites.

Q: Will I receive a certificate upon successful completion? A: Yes, some of these courses offer fairly sophisticated bookkeeping training and offer certificates upon program completion.

Q: Can I access course materials after completion? A: This varies by course. Some may offer ongoing access, while others might have time limits.

Q: Are these courses recognized by professional bookkeeping organizations? A: These free courses are great for personal development, but may not count towards official certifications. Check with professional bodies for accredited programs.

Q: How much time should I dedicate to these courses? A: Most courses suggest 3-5 hours per week, but the beauty of bookkeeping training online is its flexibility!

Ready to Balance Those Books?

Whether you’re a small business owner looking to get a handle on your finances or an aspiring professional bookkeeper, these free online bookkeeping courses offer a fantastic starting point. Remember, good bookkeeping is the foundation of a healthy business – so why not invest some time in building those skills?

From mastering the basics of the accounting cycle to tackling complex financial analysis, there’s a course here for everyone. So, grab a cup of coffee, fire up your computer, and get ready to dive into the world of debits, credits, and balance sheets. Your future financially-savvy self will thank you!

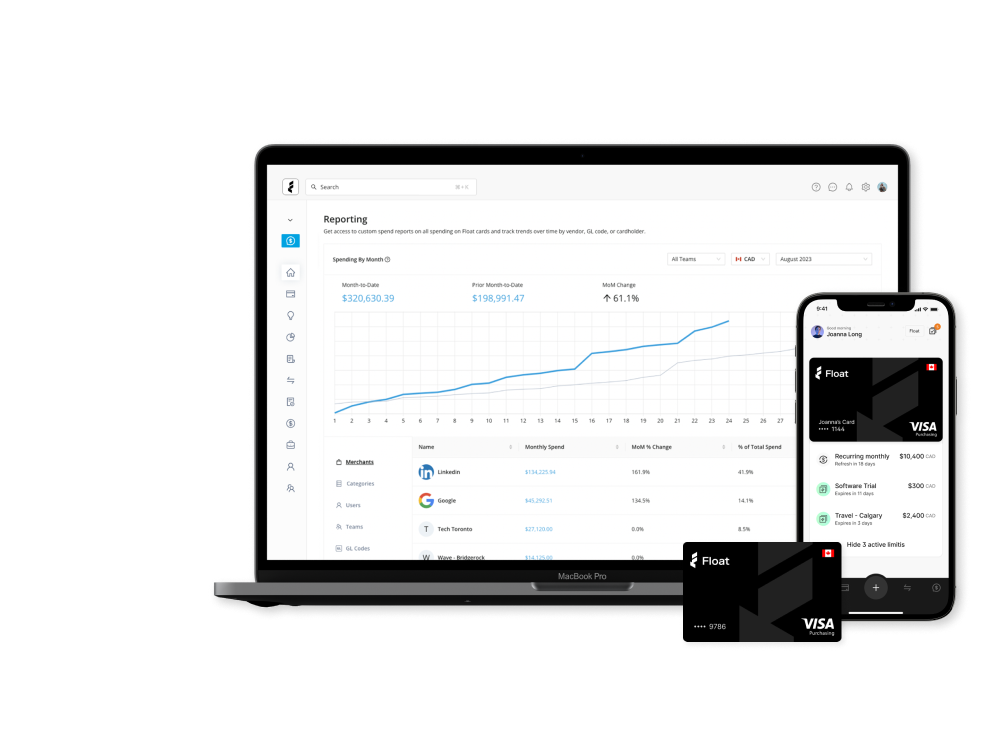

For more Canadian Business insights and best practices, follow Float’s Industry Insights content!