Get a personalized demo

Get a peek at how Float can help your business spend smarter today.

WHY MARKETING AGENCIES CHOOSE FLOAT

Less finance busy work, more client work

Float is a business finance platform for Canadian companies. Our platform pairs smart corporate cards with software automations to more easily manage your corporate and employee spend.

EXPLORE FLOAT TO SEE HOW YOU CAN

See How Float Works

Deliver more Client Value

Understand how your clients are spending, your projects are trending,

and never overspend a client-approved budget again

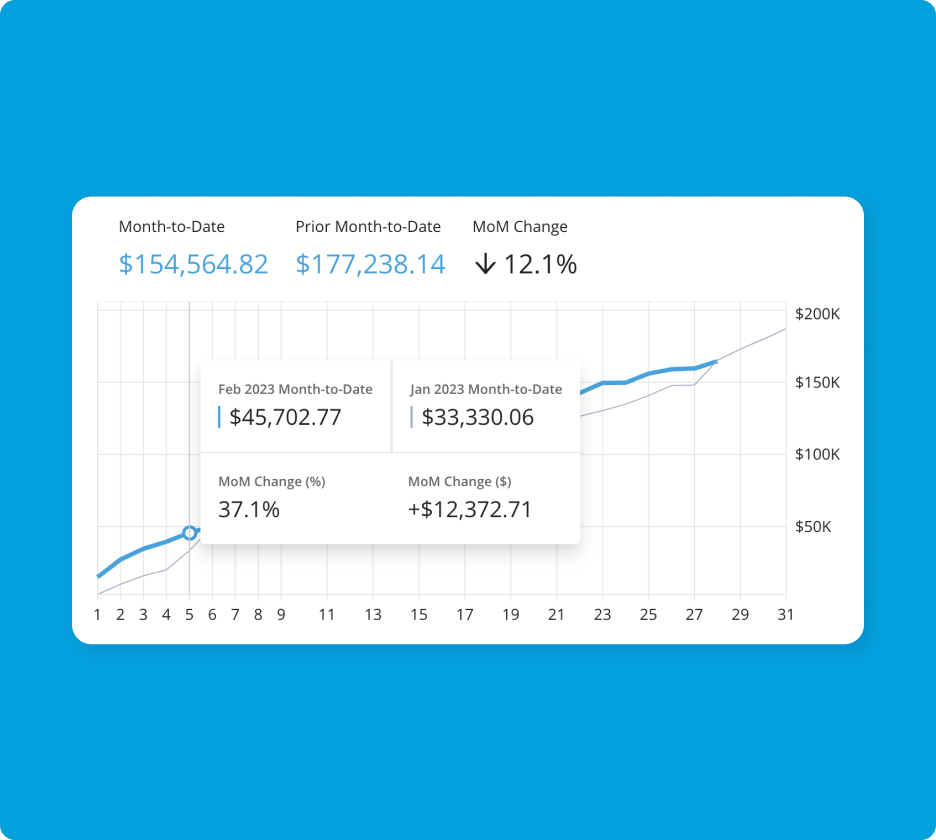

Track spend by client

Monitor real-time spending for each account to identify growth opportunities and lagging accounts. Track card spend by project, vendor and GL code for an in-depth view into trends.

Never overspend a client account again

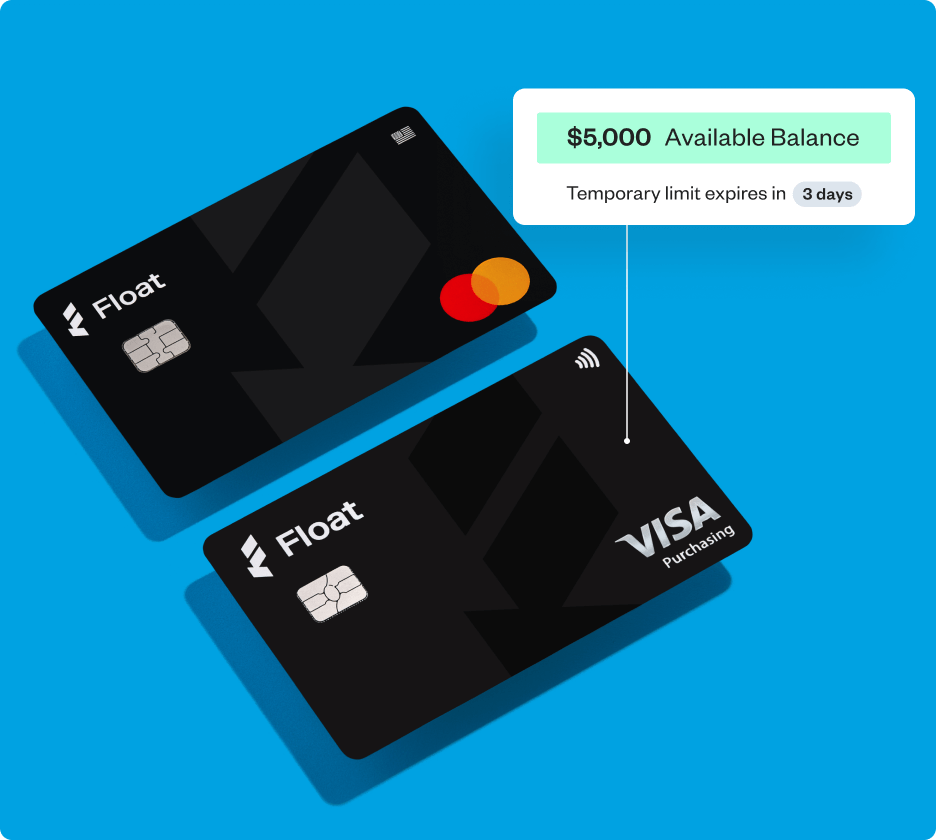

Create vendor and project specific corporate cards, instantly.‡ Use both recurring and temporary limits to enable account teams to only spend within your client’s guidelines.

Get those

darned receipts

When it comes to getting receipts on-time, there’s no better solution than Float.

Spend management in your pocket

From spend requests to receipt capture, Float’s mobile app gives your teams easy on-the-go business spending and tracking for every project need.

Get receipts faster and customize the notifications you send cardholders in Float’s new Notification Centre.

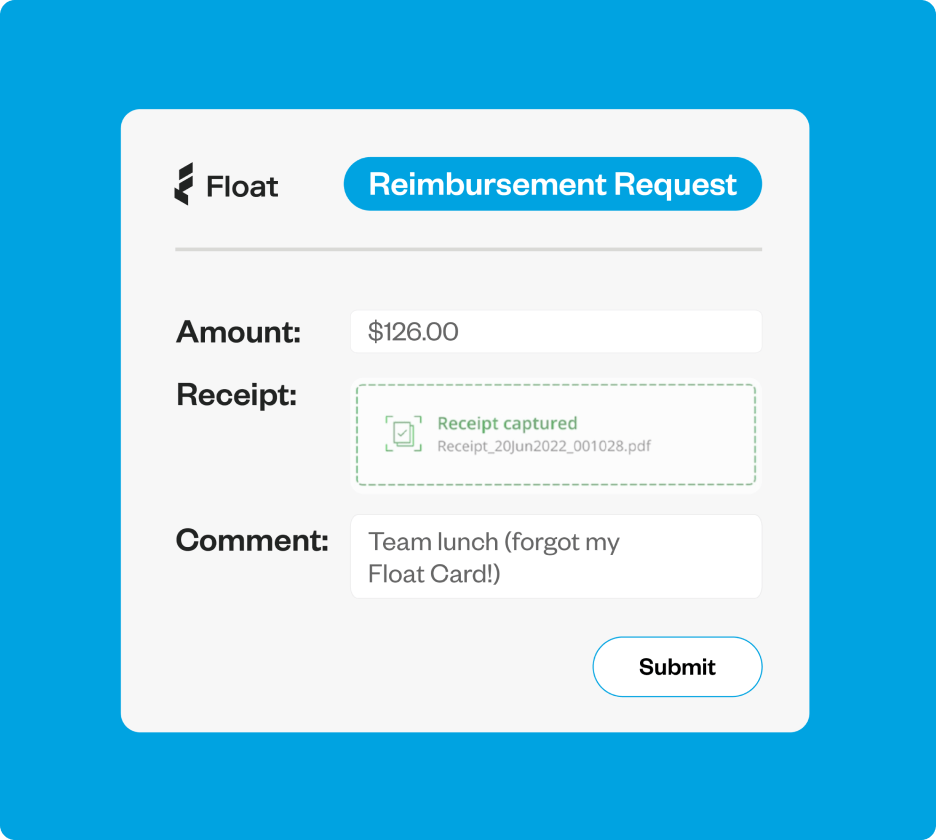

Reimbursements

No more freaking expense reports.

Employees who don’t have Float cards can easily submit out-of-pocket expenses directly in Float. Get visibility of all your company spend in one place and eliminate tedious, manual reporting to streamline approvals and payouts.

Say goodbye to

surprise charges

Float’s card controls reduce the risk of unexpected or

unauthorized spending so you can sleep better at night.

Control How Employees Spend On Corporate Cards

Be proactive in controlling company spend in 2024.

Create unlimited virtual cards for every employee, project and account. Restrict spend at custom merchant categories on your company Float Cards to ensure employees only spend funds on what they’re supposed to.

Need an added layer of control? Set up Transaction Reviews so managers can audit team purchases after they’re made.

74%

of customers reported

saving on unwanted spend because of Float

*Based on customer survey data

Earn 4% on Your

Float Balance

Get better rewards than the Big Banks with Float Yield –

earning 4% on your Float balance.

Float High Yield Accounts

Get better-than-bank rates as we offer 4% interest on your Float balance, starting from the first dollar. No lockups, so you can withdraw at any time with no penalties.

More cash(back)

Cha-ching! Compound your Yield earning and get 1% cashback for every prefunded dollar you spend. Plus, get low FX Fees on USD transactions. Now that’s better spending.

Float’s new Banking Hub lets you easily connect multiple financial institutions so you can become eligible for credit products.

Book a Demo

Get a Personalized Demo

Book a demo and get a peek at how Float can help your business spend smarter today.

Learn how marketing agencies use Float

See corporate cards and software in action

Find out how much you could be saving

*Rates and figures are an estimate based on customer surveys and platform data.