We’re excited to announce that Float’s new USD smart corporate cards are here to help you simplify your U.S.-dollar business spending.

You and your team can spend, track, approve and reconcile all your business expenses no matter which currency you’re spending in. Our USD smart corporate cards can be used anywhere Mastercard is accepted – which is basically everywhere. Whether you’re purchasing new software, going on a business trip or need to stock up on product inventory, we’ve got you covered. 🙌🏻

It’s easy as 1, 2, 3! ⬇️

Step 1:

Connect your USD bank account to Float

Step 2:

Issue an unlimited* number of physical or virtual USD cards to employees or vendors

Step 3:

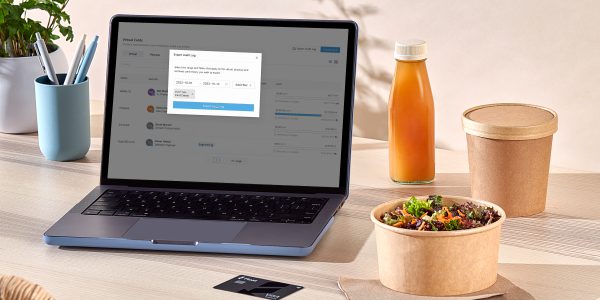

Export transactions to your accounting software at month-end and enjoy having all your receipts automatically matched, embedded, and categorized for you

With our new USD smart corporate cards, you can:

Manage your USD and CAD spending all in one place 💸

You can spend, track, approve and reconcile all of your CAD and USD expenses within Float. Regardless of which currency your team is spending in, you can track purchases and export them into your accounting software without any guesswork or confusion.

Leave foreign transaction fees at the door 🌎

With Float cards, you can avoid foreign transaction fees on USD spend by using a Float USD card. You can also link Float to your USD bank account so you can avoid your bank’s currency conversion fees.

Easily manage and pay for subscriptions and advertising 💵

Many popular subscription software plans charge in USD, like Zoom, Slack, or Deel. Advertising platforms can also charge in USD, including TikTok and LinkedIn. Float offers unlimited virtual cards, so you can instantly create a card for each vendor. With virtual cards, you can set up card controls and spend limits to limit fraud, overcharges, or cards pausing in the middle of a campaign due to low card limits.

Quickly pay and reconcile U.S. travel expenses ✈️

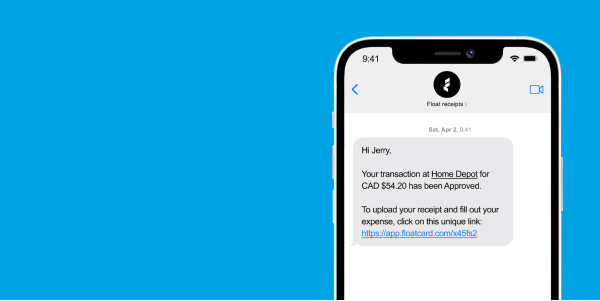

Hooray! You can now issue physical USD corporate cards to your travelling employees. All cards are linked to your Float software and set up with individual card controls and automated receipt compliance, giving you full visibility over team spending regardless of the time zone they’re in. Your team can now travel stress-free and easily make business purchases without having to wait for any management approvals. Even better, you’ll never have to hound them for receipts ever again – Float will notify them to upload a snapshot any time they make a transaction. 🧾

Get access to USD corporate cards with high limits with no personal guarantees 💳

Big banks make it difficult to access corporate cards in general, let alone those in USD currency. Many banks will require you to have a legal US entity before issuing you a US-based bank account or corporate card. Float offers easy access to USD corporate cards with high limits and no personal guarantee – so you can spend with ease and accelerate your company’s growth worldwide! 🚀

—

Float’s USD card is ideal for Canadian businesses that earn and spend USD. Does your team need access to USD smart corporate cards? Float provides fast approvals with no personal guarantees or credit checks needed. Book a demo with us today or sign up for free!

*Unlimited physical and virtual cards for Professional Plan members. Essential members get unlimited virtual cards and 5 physical cards.