Product Education

Say Goodbye to Year-End Headaches With Automated Expense Software

The whole point of year-end accounting is to ensure that your financial data is up to date and recorded correctly. So why are so many companies sticking to archaic year-end processes that do more harm than good?

November 30, 2021

It’s that time of year again! Everyone’s getting in the festive spirit, with no shortage of holiday office parties, dinners and team activities. 🎄 Then comes year-end ruining all the fun. 😑 It’s no secret that closing the fiscal year is always a hectic time for finance and accounting teams. And it doesn’t help that most companies are leading with outdated and inefficient processes that only cause further delays and headaches.

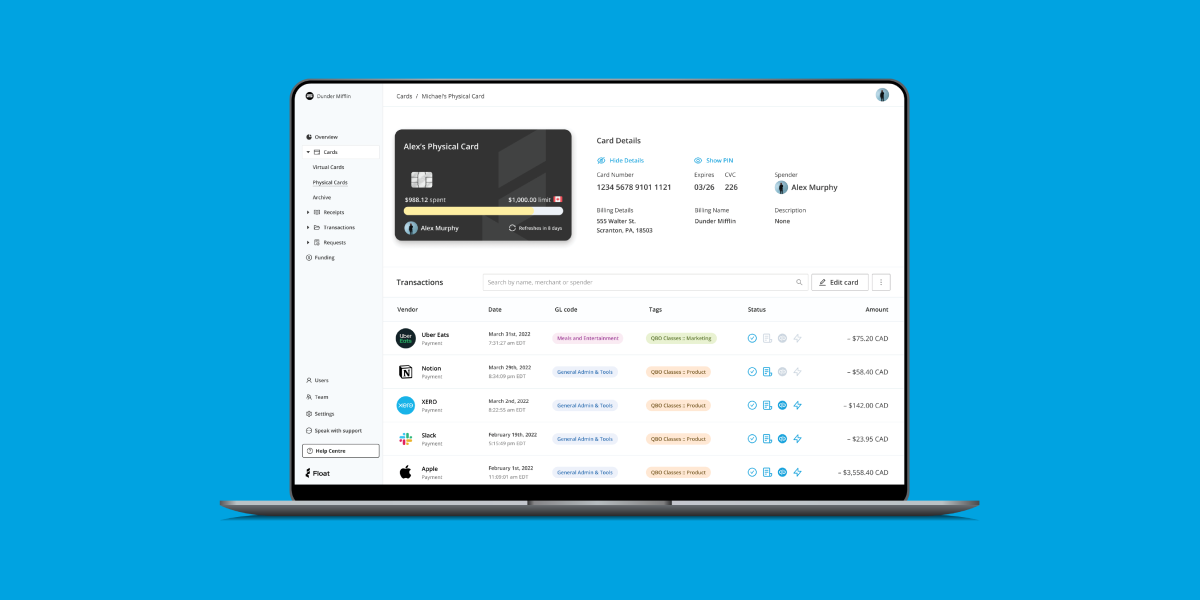

Luckily, things don’t have to go on this way. Think of automated expense software as the Tylenol to your year-end headaches. 💊 It simplifies your year-end by eliminating expense reports, automating reconciliation, tracking purchases and receipts in real-time, streamlining spending approvals and requests and more. It also gives financial teams quick access to financial reporting for better business planning and decision-making. ✅

Leave manual reports in 2021 👋

Manual expense reports are a waste of valuable time and money, especially this time of year. They’re prone to human error and can potentially compromise the accuracy of critical financial data in your annual reporting. These outdated processes not only take long but they can impact your credibility with key stakeholders like investors or your board of directors.

Automating year-end processes not only reduces these risks, but it eliminates expense reports altogether. Finance and accounting teams can verify data, record and manage invoices and receipts and generate real-time reporting with speed and accuracy. It also minimizes all of the back and forth with employees and teams, cutting all those long hours and late nights at your desktop. 😴

Stay organized all year round 🗓

With the holidays coming close and employees likely taking time off, year end is not the time to be chasing people down for receipts. Automated expense software helps companies better control and manage spending 24-7-365 so that year-end isn’t a massive pile of paperwork and receipts. It introduces a more proactive approach to corporate spending with features that streamline key processes on your year-end to-do list:

- Reconcile your books in a flash ⚡️

- Track business purchases in real time 💸

- Create simple financial policies for all employees to follow 🙌🏾

- Instantly notify employees to submit receipts when they spend 🧾

- Set spending limits and approve spend requests in seconds 👍🏼

- Collect and review key financial data all in one place 👀

This keeps internal teams, financial controllers and management all aligned and organized at any point of the financial year, with no guesswork and zero stress.

Separate business and personal with virtual cards 👏

Blurring the lines between personal and business expenses is a common mistake many businesses make – with the consequences often creeping in at annual close. 🤯 When employees use their personal credit cards for business purchases, this can make it 10x harder to track and control spending. We know that your average Canadian bank makes it even more difficult to issue corporate cards, which is why so many of us turn to our personal cards to make purchases. Good news, we have a loophole! 😉

Fully integrated with your automated expense software, virtual cards like ours at Float make it easier for businesses to issue credit cards to employees in less than a week, removing personal credit from the equation entirely. With access to virtual cards, employees have greater autonomy and more power to make responsive decisions for the business without jumping through various hoops for approval.

End the year strong with Float 🤩

If you’re still doing things the old-fashioned way, it’s likely that your finance and accounting teams are approaching year-end feeling overworked. Well guess what, Float can help! Our automated expense software and virtual cards make it a whole lot easier to close the year without your finance team burning out.

Float fosters a strategic partnership between finance teams and the rest of the organization by making it easy to create and follow financial policies and stay organized daily so that year-end headaches are a thing of the past.

To learn more about how Float can help you close the year, book a demo today!

Written by

All the resources

Float News

New! Bill Pay and Reimbursements

Float is the first business finance platform in Canada to offer an end-to-end solution that simplifies all non-payroll spending.

Read More

Case Studies

How BenchSci Saved 40+ Hours a Month Streamlining Spend Management with Float

Trailblazing AI firm, BenchSci shares why they chose Float for secure spend management at scale.

Read More

Case Studies

Health and Wellness SaaS Company Practice Better Closes the Books 6x Faster with Float

How the growing startup Practice Better leveraged Float to bring their spend management and bookkeeping in-house.

Read More