Close your books up to

8x faster this year

Get a peek at how Float can help your business spend smarter today.

YEAR-END ROUNDUP

Stress less this year(end)

Float’s 2023 Year-End Roundup is full of insight on how you can tackle your biggest priorities with our latest releases, so you can get more time back for what really matters – even if that’s a post-holiday nap.

What’s Inside

Explore the latest features that let you:

Get those

darned receipts

When it comes to getting receipts on-time, there’s no better solution than Float.

RECEIPTS

Mobile App

Float closed the year with a bang with its new mobile app for Android and iOS.

From card requests to receipt capture, your teams get access to easy on-the-go business spending, all within your company guidelines.

Get receipts faster and customize the notifications you send cardholders in Float’s new Notification Centre.

Enable teams

to spend

Manage all your team spend (from request to reconciliation) in one simple platform.

SPEND

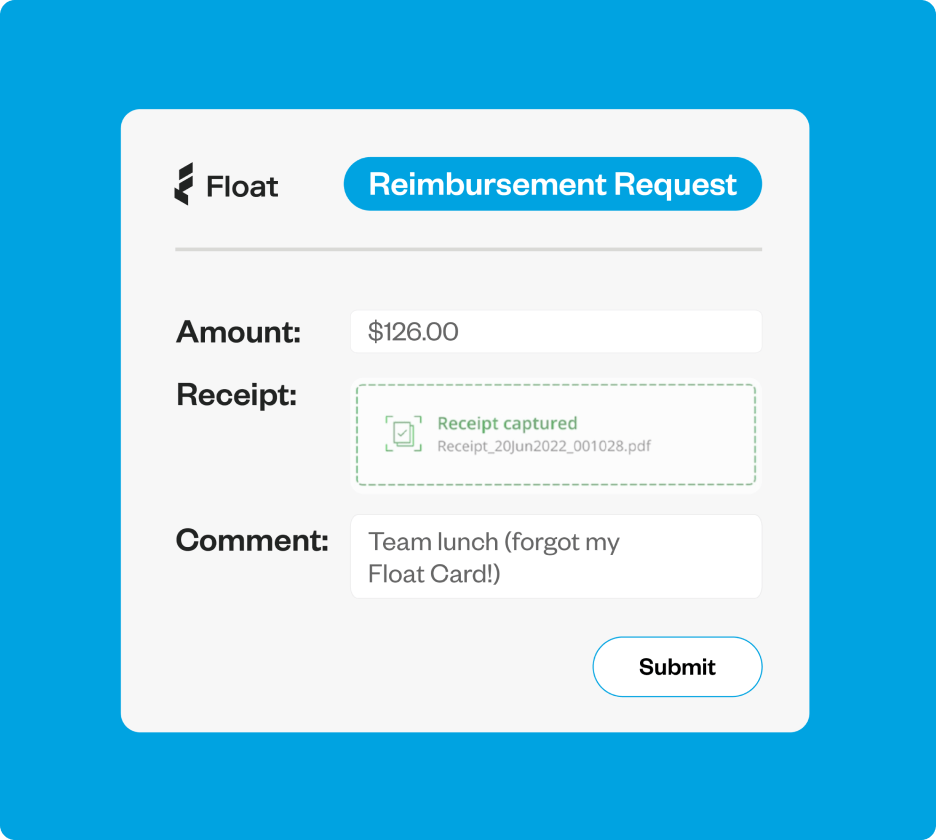

Reimbursements

No more freaking expense reports.

It’s incredibly easy to submit out-of-pocket expenses directly in Float. Get visibility of all your company spend in one place and eliminate tedious, manual reporting to streamline approvals and payouts.

LEARN

Expense Policy Template

Easily create your company’s expense policy with Float’s customizeable template for Notion and Google Docs.

SPEND

Float Cards 2.0

Float’s corporate cards got even smarter in 2023 with the ability to create cards with $0 balances and add custom limits only when required.

Issue cards to employees worry-free or securely create vendor-specific virtual cards with recurring limits, and enable teams to spend within your company’s guidelines.

SPEND

Onboard your teams to Float

Set new employees up for success with Float’s new HRIS Integration and create custom approval workflows based on your company’s org structure with Dynamic Approvers.

Close books

faster

Improve your month-end close by one full business day using Float.

WATCH

My Float Face

We’ve all been there. Sheer frustration with expense reports. Pure exhaustion at month-end. Knots-in-stomachs before board meetings.

Thankfully finance teams can turn those frowns upside down and finally enjoy freedom from the financial annoyances that held them back from being their best professional-selves.

By experiencing business spending the way it should be; with Float.

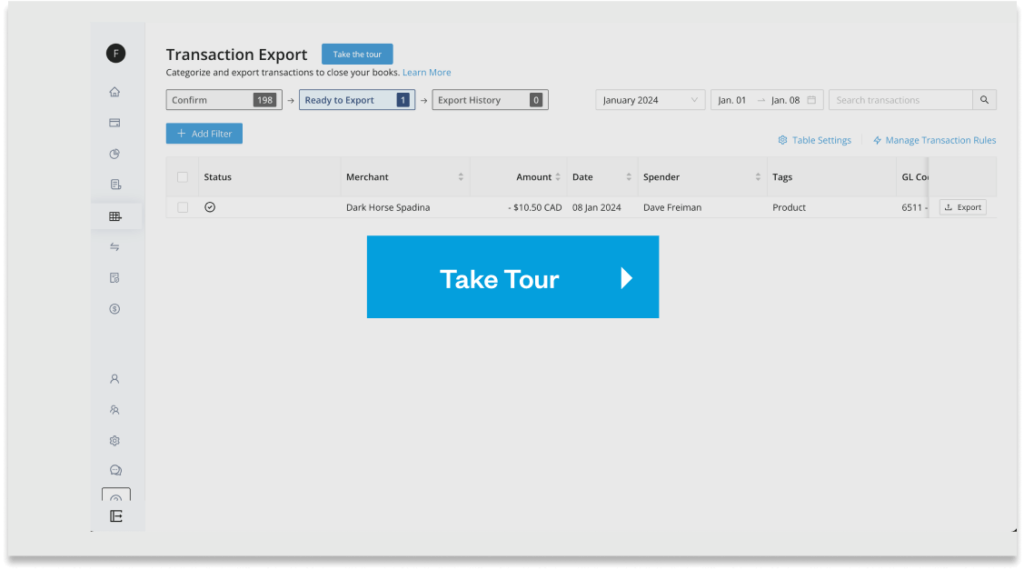

CLOSE

No integration?

No problem.

Build your own re-usable CSV export template, download your transactions at month-end, and seamlessly import them to your accounting software already coded and embedded with receipts.

8x

Close transactions and reimbursements up to 8x faster at month-end

Save on

unwanted spend

Never be surprised by a charge. Surface insights that stop unwanted spend and drive savings.

CONTROL

Merchant Controls

Be proactive in controlling company spend in 2024.

Restrict spend at custom merchant categories on your company Float Cards and ensure employees only spend funds on what they’re supposed to.

Need an added layer of control? Set up Transaction Reviews so managers can audit team purchases after they’re made.

CONTROL

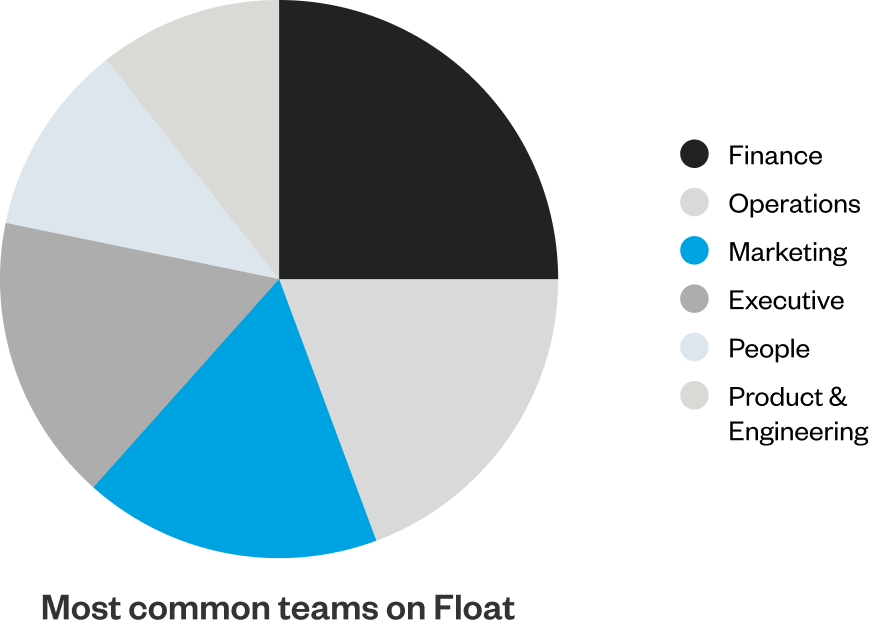

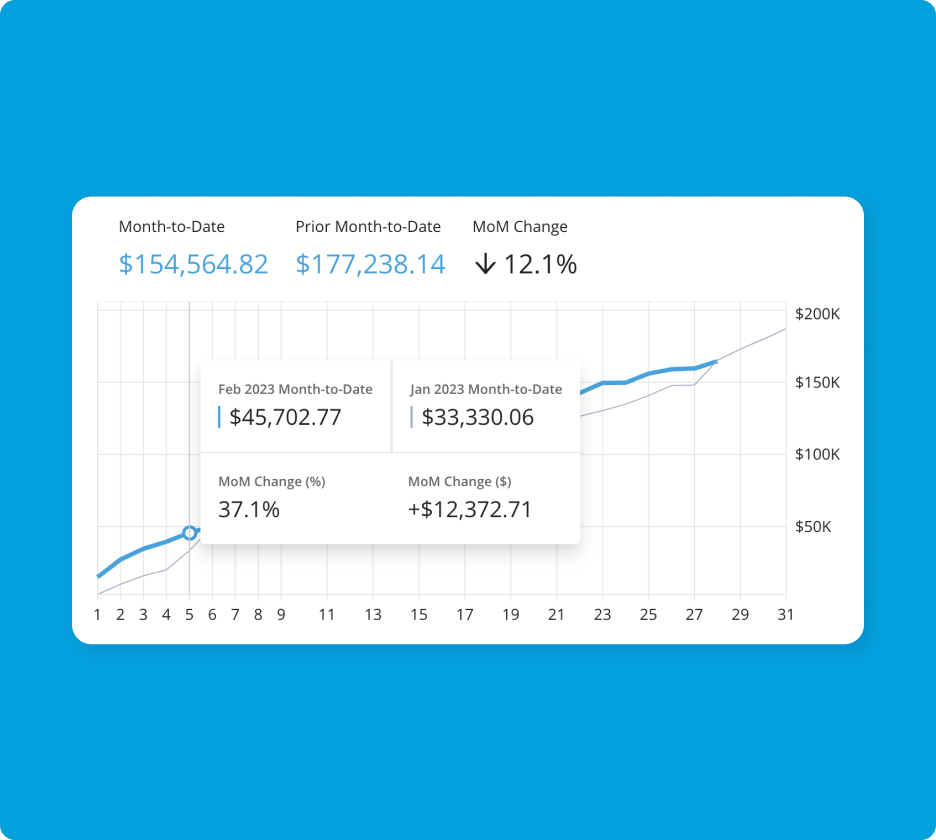

Reporting

Float’s Reporting dashboard was added to the platform to meet finance professionals most pressing need – real-time visibility into company spend.

Track trends, spot spend anomalies, and easily get the data you need to make decisions quickly.

74%

of customers reported

saving on unwanted spend because of Float

*Based on customer survey data

Increased Savings

and Security

Secure and optimized cash flow alongside smart business spending.

SAVE

Float Yield

Get better-than-bank rates as we offer 4% interest on your Float balance, starting from the first dollar. No lockups, so you can withdraw at any time with no penalties.

SAVE

Fast Funding

Whether you’re on Float’s Pre-funded or Charge products, spend is seamless. We fast-tracked top-ups to eligible customers’ Float Accounts, so you can access funds without delays.

Float’s new Banking Hub lets you easily connect multiple financial institutions so you can become eligible for credit products.

You’re in safe hands

In 2023 Float became SOC 2 Type 2 and PCI-DSS certified – protecting your personal and financial data with industry-leading compliance.

Book a Demo

Want to stress less this year?

Book a demo and get a peek at how Float can help your business spend smarter today.

Learn how modern finance teams use Float

See corporate cards and software in action

Find out how much you could be saving

*Rates and figures are an estimate based on customer surveys and platform data.