Ready to learn more? Reply YES!📱

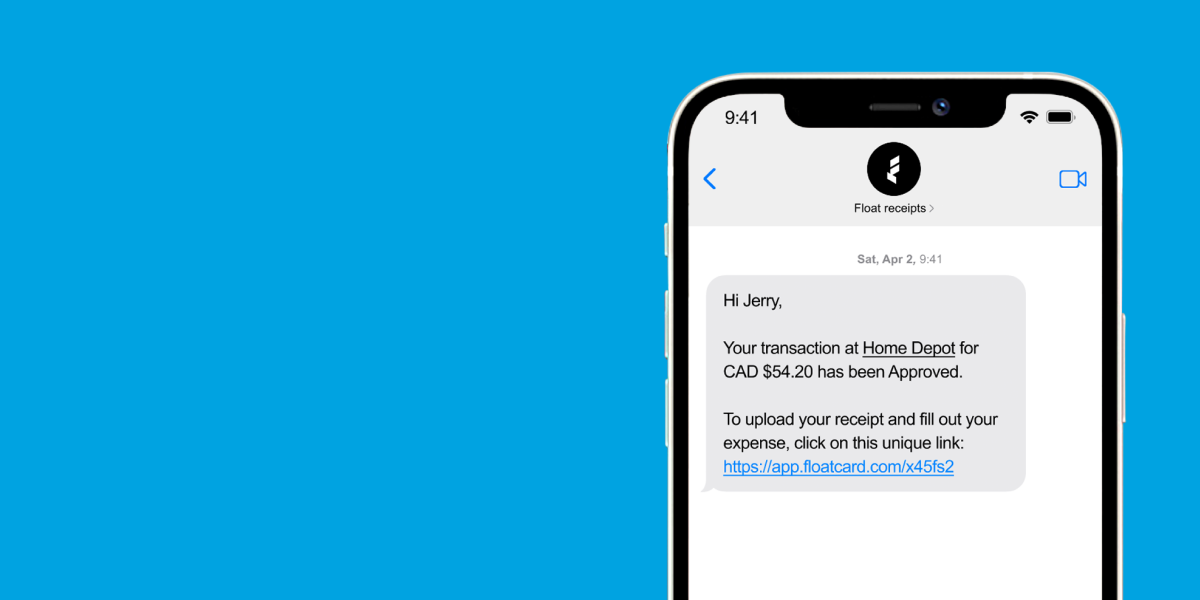

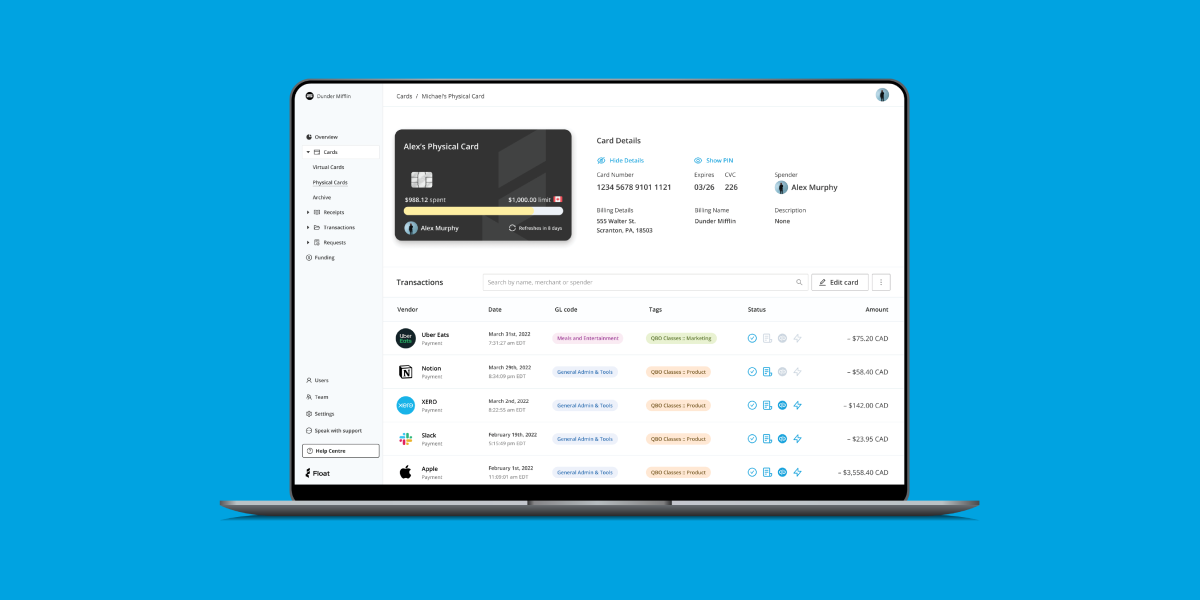

Allow us to introduce you to our SMS Tracking feature. It gives users the option to add a phone number to their Float account so that every time a request or purchase is made on their Float card, they receive a text with the details of their transaction. This will include the vendor name, approval status and total dollars spent. Shortly after receiving the first text, users will then be notified to text back a picture of their receipt. If the receipt is sent back within 10 minutes, it can be stored in the Float platform and automatically matched with the transaction for easy review. 👨🏻💻

It’s the most convenient expense management tool around 👍🏼

With our SMS Tracking feature, employees no longer have to collect and save their expense receipts and managers don’t have to chase them down ever again. Spenders can simply snap a photo of their receipt after every purchase, submit it within Float and toss the physical receipt away. This feature also notifies cardholders of every transaction made via text, making it easier to identify any fraudulent activity or inaccurate charges. 👀 If you’re travelling for work, taking photos of your receipts versus collecting physical receipts will save a lot of time and keep things way more organized.

The Benefits of SMS Tracking

Employees can track their own spending 💸

Users can view and monitor their own corporate spending and see their approvals in real time. For example, if they were to make an online transaction, they could instantly see if the request was approved, make the purchase and confirm whether the purchase went through. Sometimes you don’t realize if a transaction was rejected unless you revisit the website, but this feature makes it 10x easier by instantly notifying spenders if the transaction was completed. ✅

Easy receipt collection and matching 🧾

Employees no longer have to worry about keeping a pile of receipts and submitting them to the finance department at month end. They can simply snap a photo after a purchase is made and send it off for the OCR tooling software to work its magic! If a receipt is submitted within 10 minutes of a purchase, the software can automatically recognize the receipt and match it to a transaction. This will save your finance team hours of valuable time, removing the need to manually collect, review, match and mass upload thousands of receipts!

Allows for seamless spending with no interruptions 💳

Float allows finance managers to pause purchases on corporate cards if a certain amount of receipts haven’t been submitted. It’s a great incentive to hold employees accountable to their spending responsibilities — and the SMS tracking feature is one more way to ensure this. It gives spenders an extra nudge to send in their receipts immediately and prevent their corporate card from being paused. Whether you’re in the middle of a conversation after a business meal or running to catch your flight to a conference in Montreal, it’s easy to forget to send in those receipts. With Float’s text reminders, we can help you stay on top of things for seamless corporate spending!

Smarter expense management for a happier finance team. 🤩

Let’s say it like it is. 🤷🏼♂️ When accountants don’t have the right system in place, they’re likely spending endless hours reconciling expenses and matching and collecting receipts. Float’s SMS Tracking feature cuts that time in half and allows for greater accuracy throughout the process. It speeds up reconciliation and makes it easier to manage and review corporate spending over the course of the month.

For more information on our SMS Tracking feature, book a demo with us today!