We’re feeling a little sentimental today thinking about all of our incredible customers across Canada that have trusted Float with their business spend.

Our team started Float with one thing in mind – to simplify business spending for Canadian companies and teams. From our fast (and friendly) support team to smart software that automates even the most complex Canadian tax codes, we know what unique challenges Canadian businesses are facing – and we’re committed to tackling them.

Let’s delve into what sets Float apart and why it’s the ideal choice for Canadian finance teams.

Friendly. Fast. Canadian.

At Float, we know that quick and effective support is crucial for the success of Canadian businesses, especially when it comes to money movements. That’s why our dedicated Support and Success teams are based in Canada, allowing them to understand and address the unique challenges faced by Canadian businesses.

While officially located in Toronto, ON, the Float team spans coast to coast with members from St. John’s, NL to Victoria, BC. Our team is known for our willingness to go the extra mile and understanding the intricacies of Canadian finance. And unlike the big banks, our response times are fast and satisfaction scores high – just ask any Float customer.

We know our PSTs from our GSTs

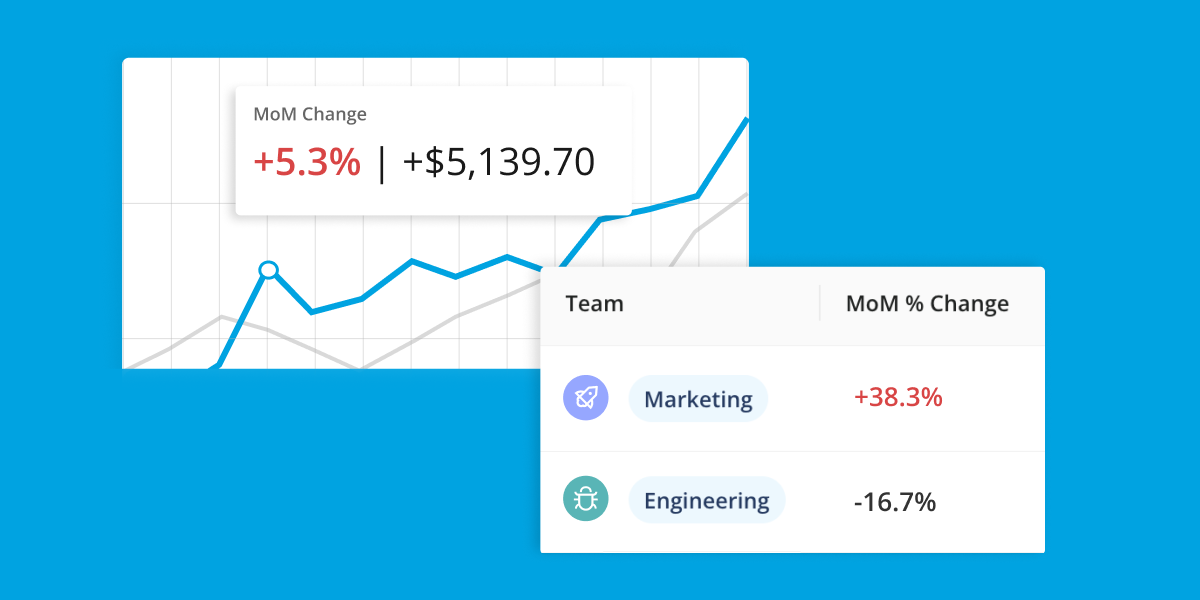

Float’s business spend software has been built from the ground-up with Canadian business needs in mind. Not only do we work closely with trusted Canadian banking partners, we also have a deep understanding of the complexities of Canada’s banking infrastructure.

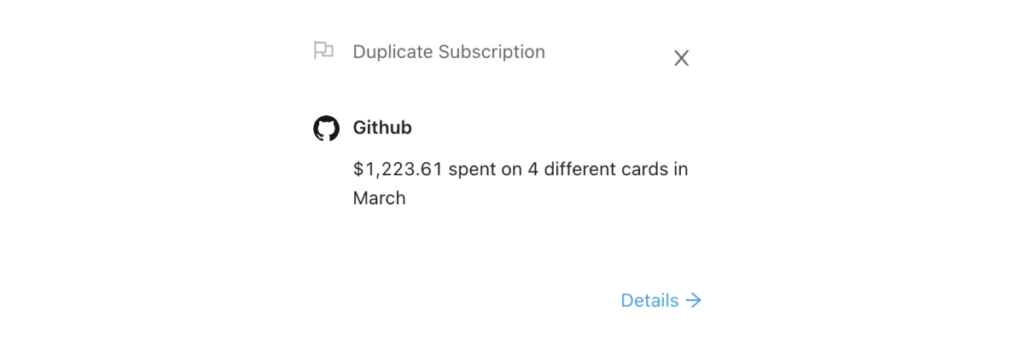

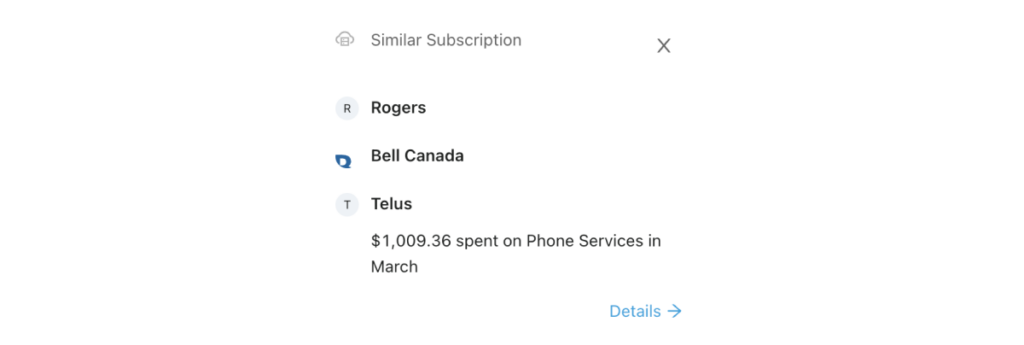

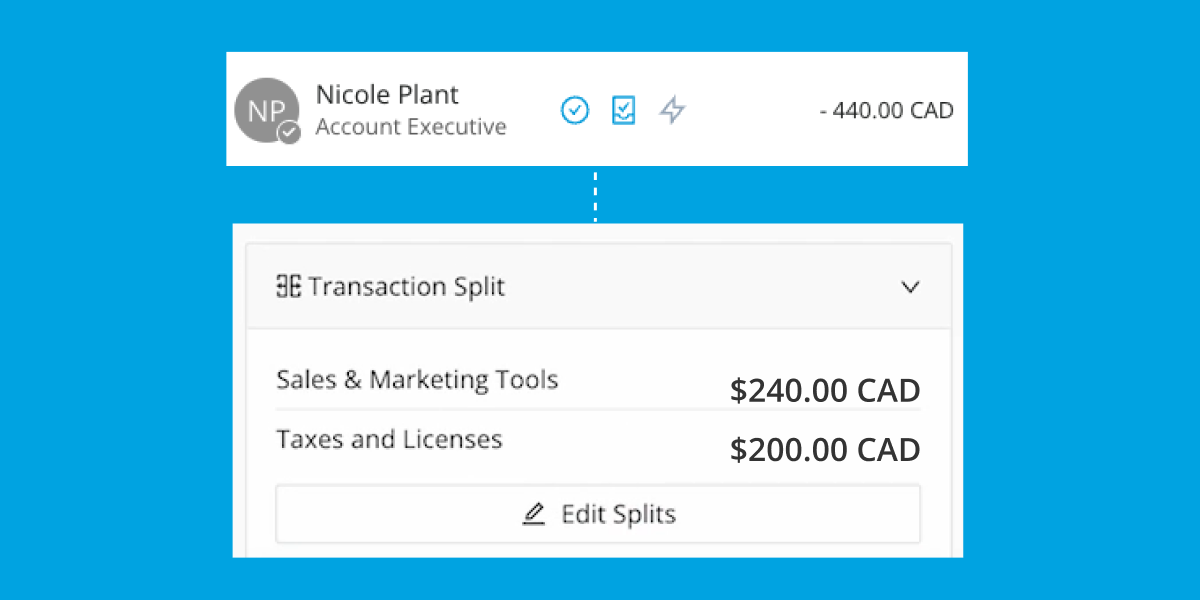

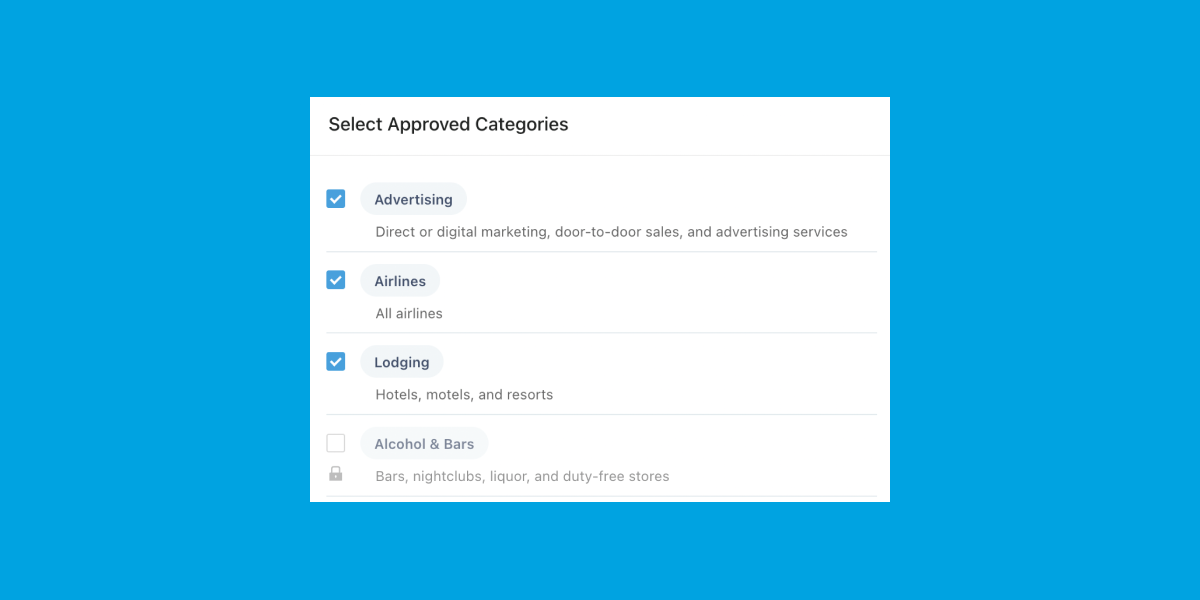

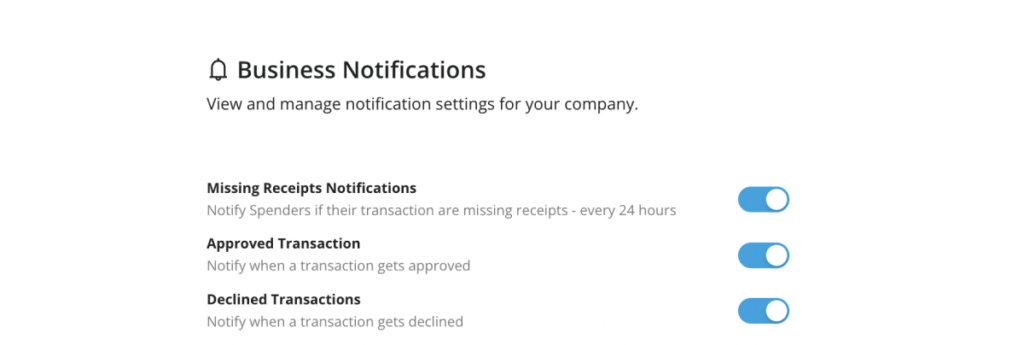

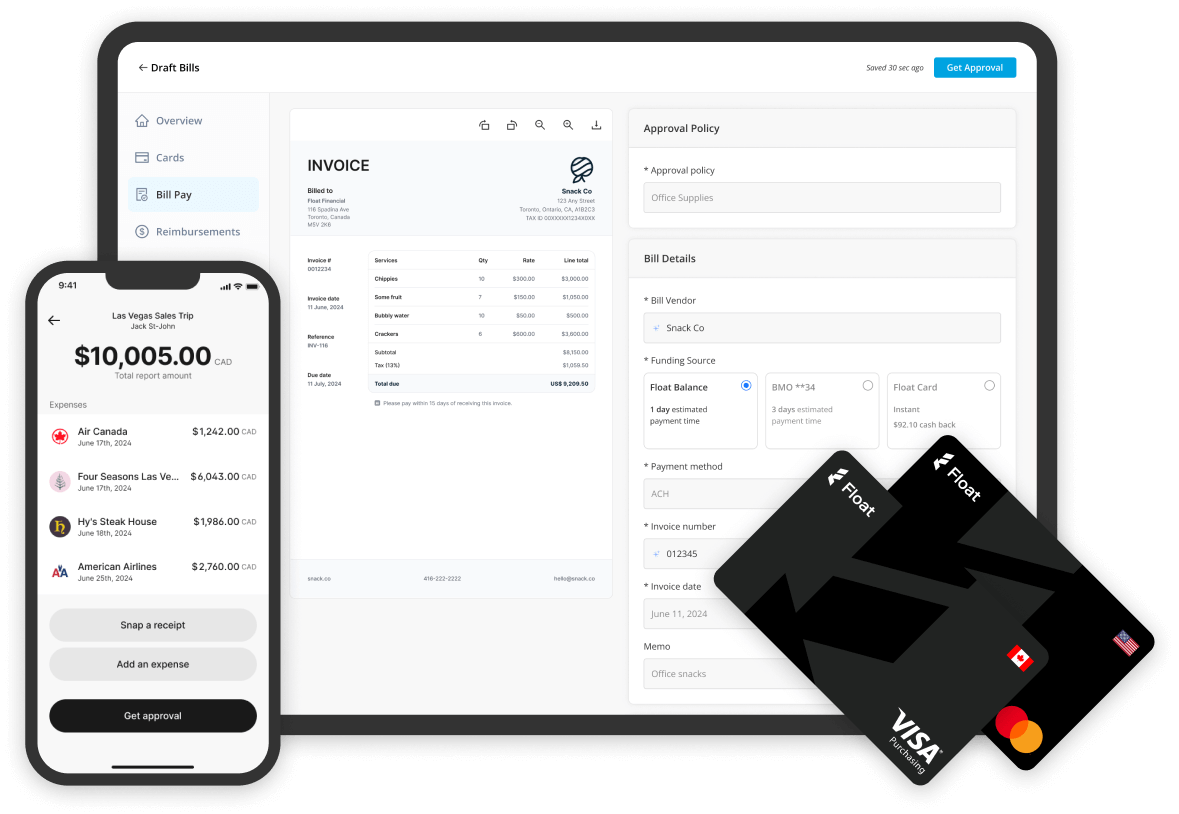

That means our features are tailored to simplify Canadian team spending, from complicated multi-part provincial tax codes to access to hassle-free USD cards.

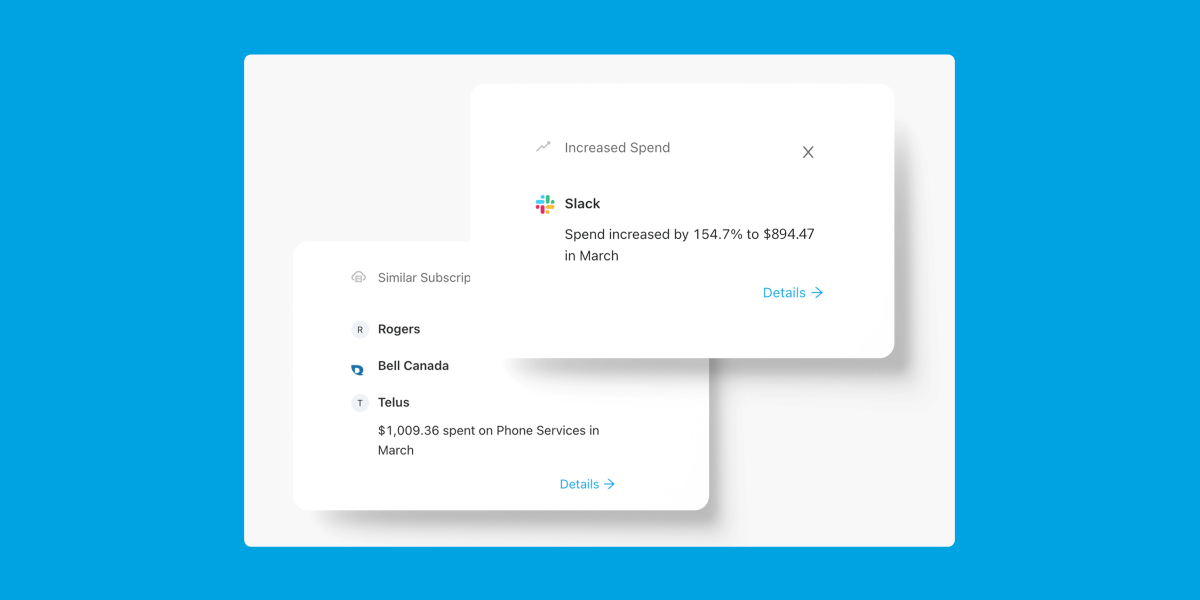

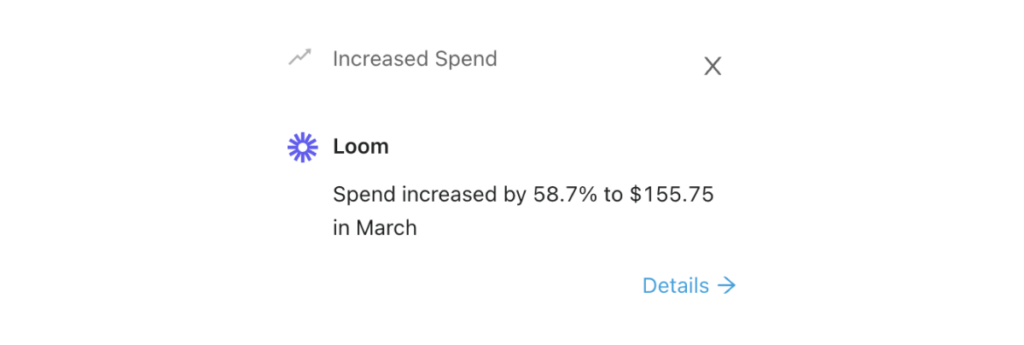

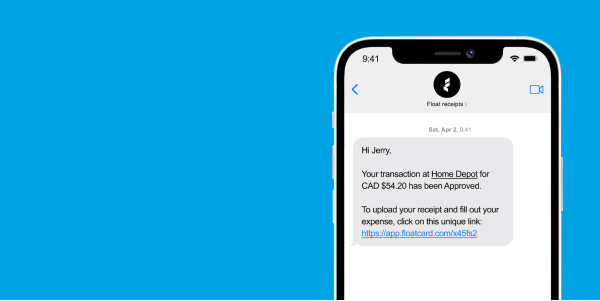

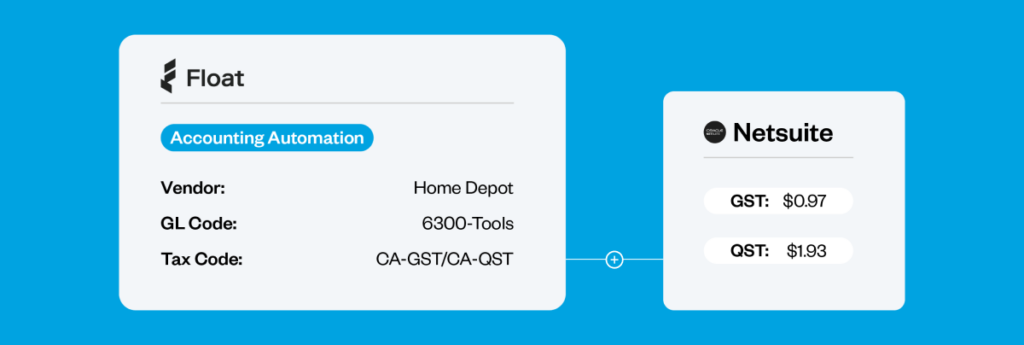

Float’s cutting-edge OCR technology enables your company’s cardholders to effortlessly scan and upload receipts as soon as a purchase is made. Even better? Float’s intelligent software accurately reads tax and tip information and parses the data back to Float. With accounting automations, you can automate tax codes and parse tax amounts directly to your accounting software according to the specific provincial tax regulations. This ensures compliance with local tax regulations, and more importantly, that your company isn’t leaving any GST refunds on the table.

A lot of Canadian businesses are also holding USD funds but aren’t able to spend them. Big banks make it difficult to get access to USD Cards without having a US entity, and you often need a US address to make purchases.

With Float you can easily spend in the currency you get paid, with quick access to corporate cards in USD paired with business spend software tailored to Canadian businesses.

We Get Canadian Business Needs

Canada’s financial landscape is unique, and before Float, a lot of content, events, and training were focused south of the border.

That’s why Float goes beyond offering a software solution, by providing resources and building a community designed specifically for Canadian finance teams.

With Float’s Retained Learnings Podcast, you can learn from Canada’s most interesting and innovative finance leaders. Or our Retained Learnings Magazine where we cover unique topics from the ultimate financial tech stacks for Canadian finance teams, to how to build a finance team from scratch in the Canadian landscape.

If you sign up for Float (or request a demo), you’ll also get invited to exclusive dinners, events, and seminars so you can connect with other leaders in the field.

—

Float offers a truly Canadian approach to business spend management with tailored product features, local support teams, and a community of connected finance leaders. Interested in learning more? Reach out to our team – we’re here to help Canadian companies simplify their spend!