Having an effective budget is the first line of defence for any startup, simply because every dollar counts. From marketing and recruiting to innovative technology and product development, setting a clear, sustainable budget makes all the difference when it comes to growing your business over the short and long term. That’s why it’s crucial that startups hit the ground running with robust processes that manage and track expenses, monitor cash flow and keep their budget in check. ✅

Every adventure starts with a roadmap. 🗺

Before stepping on the gas, it’s important to get clear on your budget and build a roadmap that will guide your corporate spending moving forward. Creating a healthy budget gives startups greater insight to operate within their means, anticipate and manage unexpected challenges and most importantly, drive revenue. It’s the ultimate tool for identifying where your money needs to go in order to grow. 💸 Budgets are also the perfect avenue to optimize your company’s spending and determine which areas of the business require the most of your budget.

Take control of your cash flow before it starts to control you. 🏋🏽♂️

Many people think of budgeting as their least favourite part of running a business, but if you want to be successful, this is a critical step. A budget helps to clearly track and estimate future expenses, forecast revenue growth as well as identify capital available to reinvest in the business. Without one, your team may find themselves running out of cash too soon or spending funds frivolously – which will cause more fires to put out than anyone wants. 🥵🔥

The recipe to a healthy budget 👩🏻🍳

A budget is a detailed plan that outlines where your money will go on a weekly, monthly and annual basis. We like to think of it as a recipe for growth and success. 🍽 Here are the key ingredients:

- 1 cup of estimated revenue 💰

- This is the amount of money you expect to generate from the sales of your products or services.

- 2 tablespoons of fixed costs 💵

- These are all of your recurring expenses that won’t change based on how much revenue is generated. Fixed costs may include rent, insurance, utilities, employee salaries, accounting and legal services and equipment or software purchases.

- 1 teaspoon of variable costs 💸

- Variable costs will change based on production or sales volume. These costs are closely linked to anything associated with the production or purchase of the product or service you provide. This may include raw materials, inventory and production costs, travel expenses, corporate credit card fees, packaging costs and shipping costs.

- 3 cups of cash flow 📊

- Cash flow is all of the money coming in and out of your business. It’s the fuel to your operation, so it’s essential that you’re tracking its sources frequently. That’s where your budget comes in!

Pause and reflect. 🤔

After highlighting the components you need to develop a better budget, you should also ask yourself the following questions:

- How much do we anticipate sales to grow in the following years?

- How will we price our products and/or services?

- How much will it cost to produce our product? How much inventory will we need?

- What will our operating expenses be?

- How many employees will we need? How much will we pay them?

- Do we need any equipment or software?

- How much will we need to borrow?

Having the answers to these questions will allow you to build and finalize a realistic budget. With a better grasp on where your money is coming and going and how much you need to spend to grow, you can develop a healthy budget to support your key objectives and future-proof your business.

Your shortcut to a better budget ➡️ FLOAT.

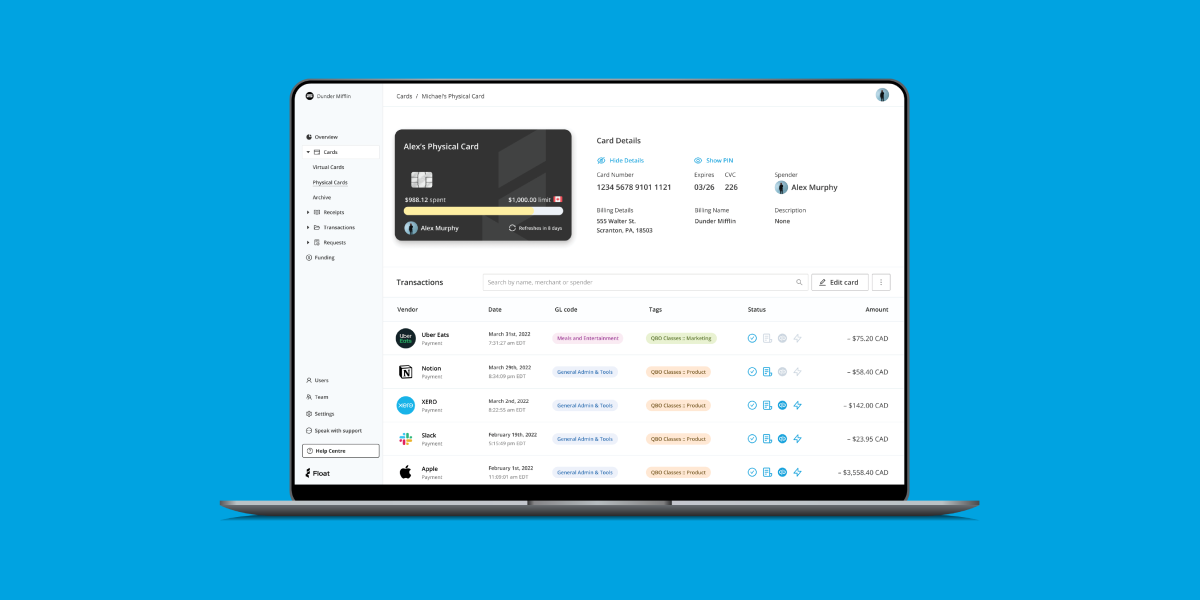

At Float, our automation spend management software gives you the tools to monitor your corporate spending, create a healthy budget (and stick to it). 😉 With the help of smart technology, Float tracks and controls spending in real time, instantly records receipts and invoices and manages your accounts receivable and payable all in one place. Not to mention, we give companies quick access to virtual and physical corporate cards for employees, making it easier to stay on budget and promote healthy spending habits company wide. At the end of the day, Float helps teams and departments stay aligned on budget expectations to remain agile and accountable on your journey to growth!

To learn more about Float, contact us today.