Industry Insights

Why Expense Management Automation Is a Good Idea

If you’re a company looking to streamline your financial processes, automated spend management software will flip your biggest pain points right on the head.

September 14, 2021

Companies in nearly every industry have fallen prey to the manual, time-consuming tasks that come with finance and expense management. From chasing receipts and tracking expenses to endless hours of reporting, these archaic processes have been causing headaches and delays for far too long. But don’t worry, you can automate that! When we add automation to the equation, companies not only eliminate this grunt work, but their finance teams gain greater visibility and control into corporate spending (in real time).

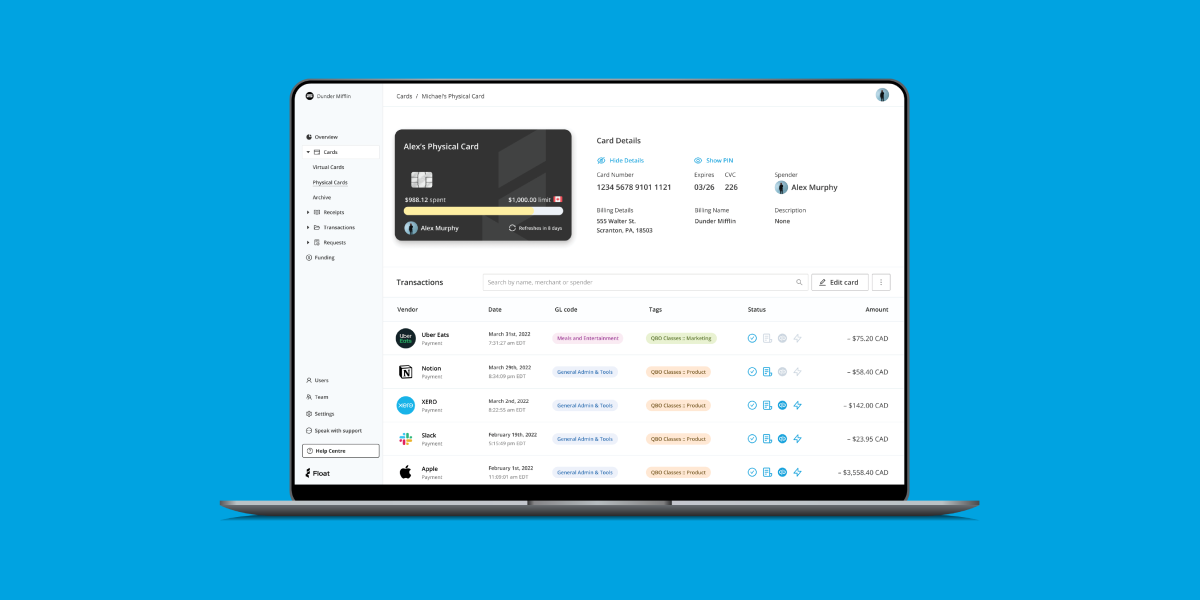

If you’re a company looking to streamline your financial processes, automated spend management software will flip your biggest pain points right on the head. It successfully optimizes these processes by allowing finance teams to easily acquire corporate cards (physical and virtual), set category spend controls, track purchases in real time, record receipts and more. It cuts the guesswork, saves time and removes the frustration of managing company financials.

Don’t wait, automate! 💨

The drawbacks of manual expense management are all too clear. So, let’s talk about the advantages and how automation boosts productivity and helps companies and startups perform at full speed.

⭐ Say goodbye to human error

Receipts get lost, expense reports are incomplete, submissions are past due and the list goes on. 😴 According to the Global Business Travel Association, 19% of expense reports come back with errors and take approximately 20 minutes to fix. If time is money, this can’t be good. 🤷🏾♂️ When companies automate their financial processes, they can ensure 100% attention to detail without lifting a finger.

⭐ Happier, more productive employees

If a startup has yet to introduce corporate cards, an employee might find themselves having to use their personal credit card to make business-related purchases and wait to be reimbursed. 🕰 If every employee has access to a corporate card that’s integrated into your automated expense software, companies can empower employees to make valuable spending decisions, reduce back and forth on requests and approvals, and eliminate the stress of having to use their own credit cards. 🎉 Financial controllers are able to set clear spending limits with category controls, and employees don’t have to worry about keeping track of their own purchases since everything is recorded instantly. It’s a win-win for everyone.

⭐️ Lower risk of expense fraud

Many fraud incidents are often associated with padded travel and expense claims 🙅🏻♂️ With automated expense software, financial controllers can instantly prompt employees to submit receipts after a purchase is made and automatically match the purchase with the receipt. This is an actionable way to prevent false or inflated claims by tracking expenses in real time and holding employees accountable through notifications. It also gives startups a better look into purchase and reimbursement history so they can detect duplicate expense reports. ✅

When businesses automate their financial and expense management processes, they can unlock the full potential of their finance teams. They are able to drive operational efficiency and accuracy and gain a full picture into corporate spending at any given time.

At Float, we support companies by giving them a simplified solution to optimize the way they spend, track and manage their money. Our corporate cards and spend management software are one step businesses can take to improve their financial processes, give employees greater access to capital and fast track onto the expressway of growth! 🏎

Want to learn more about how Float can help you take advantage of expense management automation? Connect with us today!

Written by

All the resources

Case Studies

How BenchSci Saved 40+ Hours a Month Streamlining Spend Management with Float

Trailblazing AI firm, BenchSci shares why they chose Float for secure spend management at scale.

Read More

Case Studies

Health and Wellness SaaS Company Practice Better Closes the Books 6x Faster with Float

How the growing startup Practice Better leveraged Float to bring their spend management and bookkeeping in-house.

Read More

Case Studies

Creative Production Company Makers Chooses Float to Scale Spend Management

Makers shares how they cut their time spent reconciling transactions in half while empowering spend across the company’s project teams.

Read More