Why Finance teams choose Float over Expensify

Float vs. Expensify

Expensify is a legacy (and expensive) reimbursement solution that doesn’t offer free corporate cards, 4% interest on deposits, and bill pay for Canadian businesses. Float does that and more!

Instantly create Virtual & Physical cards

First-class modern software to track spend

Close books 8x faster

Trusted by 1,000s of leading Canadian companies.†

Why choose Float?

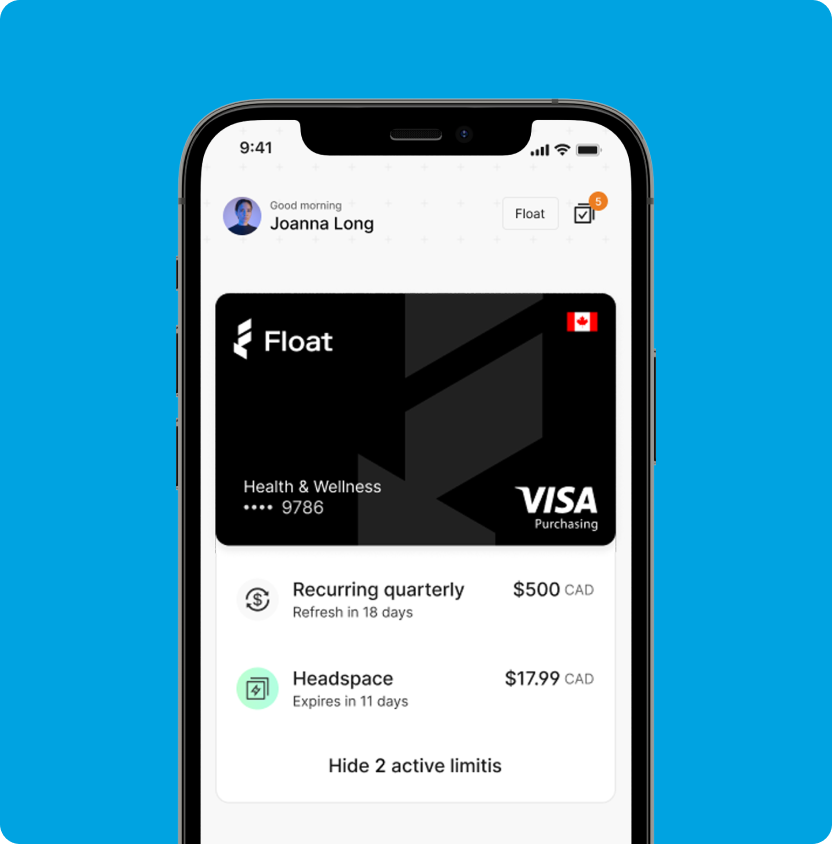

Canada’s smartest corporate card

Manage spending limits on a per-card basis and effortlessly track, approve, and reconcile expenses. Float enables you to control your card spend proactively with category restrictions and flexible limits and eliminates the need for tedious expense reports.

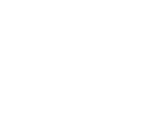

8x Faster Month-end

Expensify is extremely manual an tedious when it comes to closing your books. Float automatically categorizes expenses, helps you collect receipts from the team, and closes your books in just one click.

Let your team fall in love with Float

Float offers a modern and intuitive software experience for your team that they will love. Businesses on average save 2 hours per employee per month when switching to Float.

Why Athennian switched to Float.

“The receipt capture feature has played a big role in improving receipt compliance to close to 100% and enhancing the overall accuracy of our accounting.”

Zach Hill

Director of Finance, at Athennian

Save 7% with Float

Float is the only platform that helps companies save 7% of their total spend by offering competitive cashback, interest, FX savings and giving your employees and Finance team time back with a 8X faster month-end process.