Best Business Credit Cards in Canada in 2024

Discover the Best Business Credit Cards in Canada in 2024. Compare top options from major banks, explore rewards, fees, and benefits. Find the perfect card for your company’s needs, from cash back to travel perks. Learn about expense management essentials for small business success.

July 14, 2024

Looking for the Best Business Credit Cards in Canada in 2024? You’re not alone. Many entrepreneurs and business owners are on the hunt for the perfect plastic to fuel their company’s growth. But with so many options out there, how do you choose the right one?

Let’s dive into the world of business credit cards and explore what Canada has to offer. We’ll look at the top contenders, their perks, and how they can benefit your bottom line.

Why Bother with Getting a Business Credit Card?

Before we jump in, you might be wondering: why not just use a personal card for business expenses? After all, as a small business in Canada that might be the easiest option for you to start with.

Well, here is what’s important about having a dedicated business credit card:

- Separates personal and business finances

- Builds business credit

- Offers higher spending limits

- Provides business-specific rewards and perks

- Makes tax time a breeze

Sounds good, right? Now, let’s check out some of the best small business credit cards Canada has to offer.

The Crucial Role of Expense Management for Small Businesses

As a small business owner in Canada, you’re juggling many responsibilities – and one of the most critical is tracking your expenses. Let’s break down why this matters and how to do it effectively.

Why Expense Management Matters

- Keeps you compliant with CRA regulations

- Enables you to claim tax rebates and benefits

- Prepares you for potential audits

- Provides clear insights into your business finances

Key Responsibilities of Small Business Owners

- Accurate Tracking: You’re responsible for recording all business expenses and reporting them correctly to the CRA.

- Tax Rebate Opportunities: Proper expense tracking allows you to apply for HST and other tax rebates in Canada, potentially saving your business significant money.

- Audit Readiness: Good record-keeping ensures you can pass an audit if one comes your way, reducing stress and potential penalties.

What to Look for in a Corporate Card in 2024

When you’re shopping around for the Best Business Credit Cards in Canada in 2024, keep these factors in mind:

- Annual fee: Is it worth the perks?

- Interest rate: In case you need to carry a balance

- Rewards structure: Points, cash back, or travel miles?

- Additional cardholders: Can employees get cards too?

- Foreign transaction fees: Important for international businesses

- Insurance coverage: For travel, purchases, or even cell phones

- Digital Experience: Software integrations, easy to use banking portal, and easy expense tracking

Remember, the best card for you depends on your business needs. A small local shop might benefit from different features than a globe-trotting consulting firm.

Top Picks for Canadian Corporate Cards

Now let’s review a few options for the best credit cards for businesses in Canada.

| Card Name | Provider | Annual Fee | Rewards | Key Benefits |

|---|---|---|---|---|

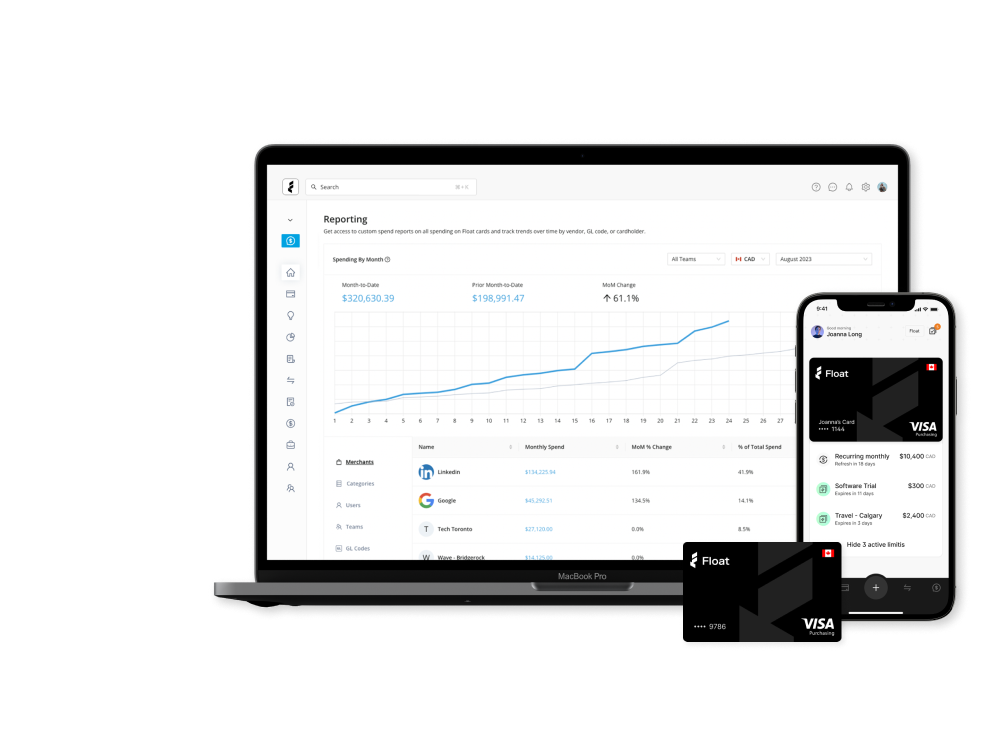

| ⭐️ Float Corporate Card | Floatcard.com | $0 (Unlimited Physical + Virtual cards) | Unlimited 1% cashback on every dollar of spend. No annual or monthly cashback caps. Total of 7% in estimated savings (learn more) | • Real-time expense tracking • Virtual + Physical cards • No personal guarantee • 4% interest on deposits |

| RBC Avion Visa Infinite Business | RBC | $175 ($79 for additional cards) | 1.25 points per $1 on all purchases. Capped out at $75k per year. When applied to statement credit 1 point is equivalent $0.58 (0.58% cashback) | • Point-based reward system • Airport lounge access |

| TD Business Travel Visa Card | TD | $149 ($49 for additional cards) | Up to 3 TD points per $1 on travel When applied to statement credit 1 point is equivalent $0.25 (0.25% cashback) | • TD Auto Club Membership |

| Scotiabank Momentum for Business Visa | Scotiabank | $79 ($29 for additional cards) | Up to 3% cash back on office supplies and electronics When applied to statement credit 1 point is equivalent $0.70 (0.70% cashback) | • Mobile device insurance • Purchase security |

| BMO AIR MILES No-Fee Business Mastercard | BMO | $0 (Free additional cards – up to 22) | 1 AIR MILE per $20 spent | • Extended warranty |

Our recommended business credit card is Float. It combines ease of use, powerful rewards, and doesn’t require personal guarantees to get started. You can sign up for Float in less than 5 minutes.

Thousands of Canadian businesses and brands like Knix, Neo, and Clutch have replaced their old cards with Float’s solution. See our customer stories and hear what our customers have to say about Float for yourself!

FAQs

Q: Can I get a business credit card if I’m just starting out? A: Absolutely! Some cards are designed for new businesses. Your personal credit might be a factor, though.

Q: Do I need to have a registered business to apply? A: Not always. Some cards are available to sole proprietors using their personal credit.

Q: Are corporate credit cards the same as business credit cards? A: Not quite. Corporate cards are typically for larger companies and often require the business to be liable for charges.

Q: Can I use my business credit card for personal expenses? A: It’s not recommended. Mixing personal and business expenses can create accounting headaches.

Q: How do business credit cards help to build business credit? A: Regular use and timely payments on a business credit card are reported to business credit bureaus, helping establish your company’s credit history.

Q: What is the best credit card for business owners? A: If you are a business owner, we recommend choosing a company credit card that doesn’t require personal background checks, can offer you high credit limits, and is easy to get started with! Float is a great option with no personal guarantee requirements!

Float – Best Credit Card for Canadian SMBs in 2024

Choosing the best business credit card in Canada isn’t just about finding the shiniest piece of plastic. It’s about finding a financial tool that aligns with your business goals and spending habits.

Whether you’re after cash back, travel perks, or building credit, there’s a card out there for you. Take the time to compare options, read the fine print, and pick a card that’ll work as hard as you do.

If you are interested in getting your hands on the best Canadian business credit card, you should definitely consider Float’s solution:

- Float offers 1% cashback on all categories of spend

- No hidden fees

- Float’s cards have excellent acceptance rates in the US and Canada – just like a normal credit card

- Float also offers 4% interest on all prepaid card balances (no minimums or lock-ins)

- Finally, Float cards also come with a completely free and easy-to-use software that also helps you manage EFT/ACH/Wire payments and Employee Reimbursements.

—

Want to learn how companies like Clutch, Neo, Knix, and 1,000s of other Canadian businesses on average save 7% of their monthly spend with Float? Get started with Float today by clicking the button below!

Want to learn more before singing up? Book a demo today to learn more about the product from our team!

Written by

All the resources

Float News

New! Bill Pay and Reimbursements

Float is the first business finance platform in Canada to offer an end-to-end solution that simplifies all non-payroll spending.

Read More

Case Studies

How BenchSci Saved 40+ Hours a Month Streamlining Spend Management with Float

Trailblazing AI firm, BenchSci shares why they chose Float for secure spend management at scale.

Read More

Case Studies

Health and Wellness SaaS Company Practice Better Closes the Books 6x Faster with Float

How the growing startup Practice Better leveraged Float to bring their spend management and bookkeeping in-house.

Read More