Product Education

How It Works: Float’s QBO Integration

Float offers a powerful two-way integration with QBO.

June 1, 2022

Is month-end craziness bogging you down? Float offers a powerful two-way integration with QBO to make spend management a breeze!

Our QBO integration feature packs a punch, offering a range of benefits to make managing your finances easy as

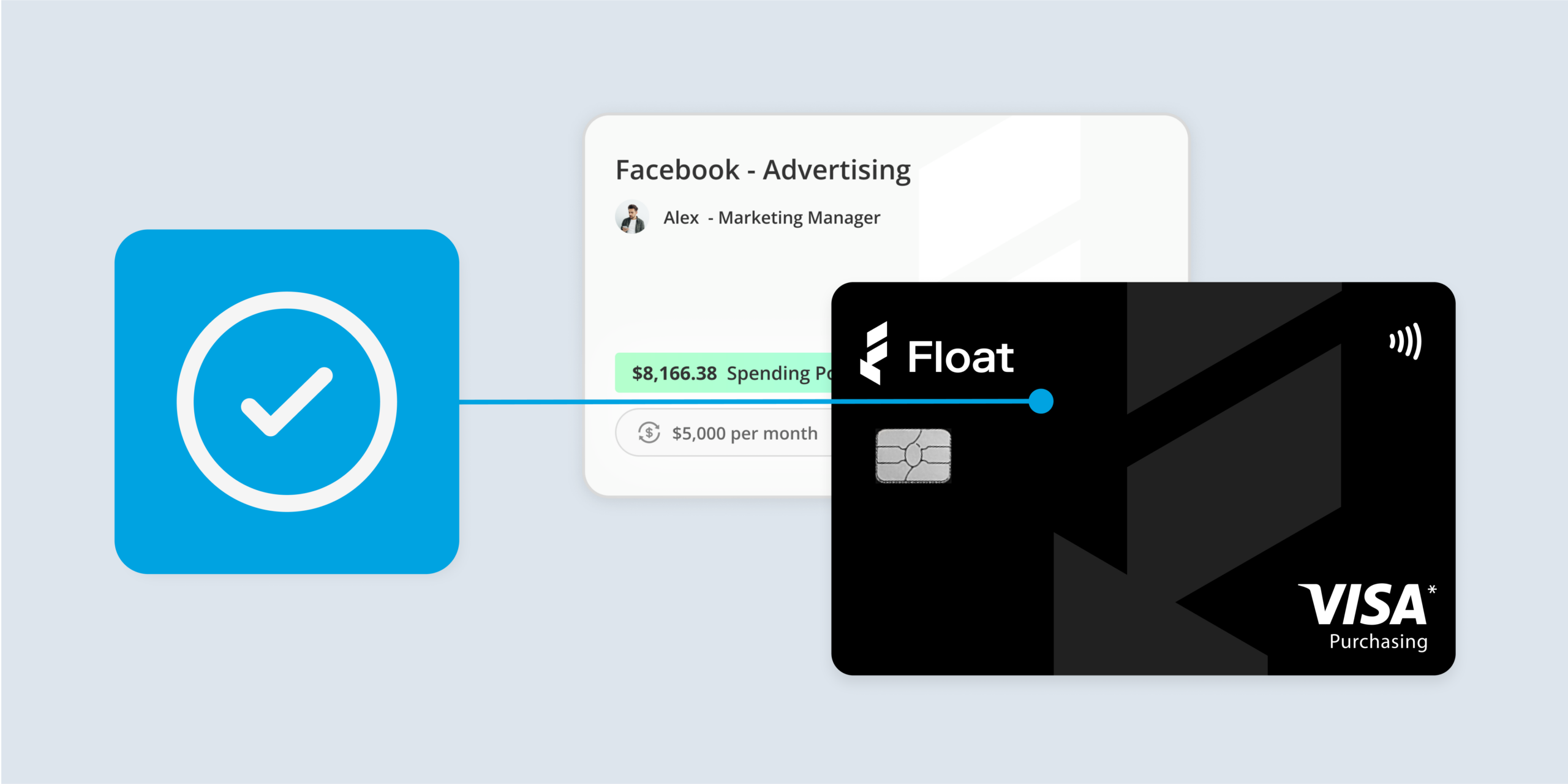

We designed this feature to sync seamlessly into your daily workflow. Our goal was to optimize the month-end process for your finance team so they could finally say goodbye to low-value tasks and guesswork. Our QBO integration feature makes it so that you no longer have to re-add and retype data with the reassurance of greater accuracy in your books – not just at month-end but on a daily basis!

With Float’s QBO integration, you manage all card-linked transactions in Float, and then directly export into Quickbooks, with transactions automatically coded and reconciled for you. Once you try it, you’ll wonder how you lived without it!

See it for yourself in this quick product tour.

Currently using Quickbooks to manage your corporate finances? Here’s how Float levels up your experience and your books:

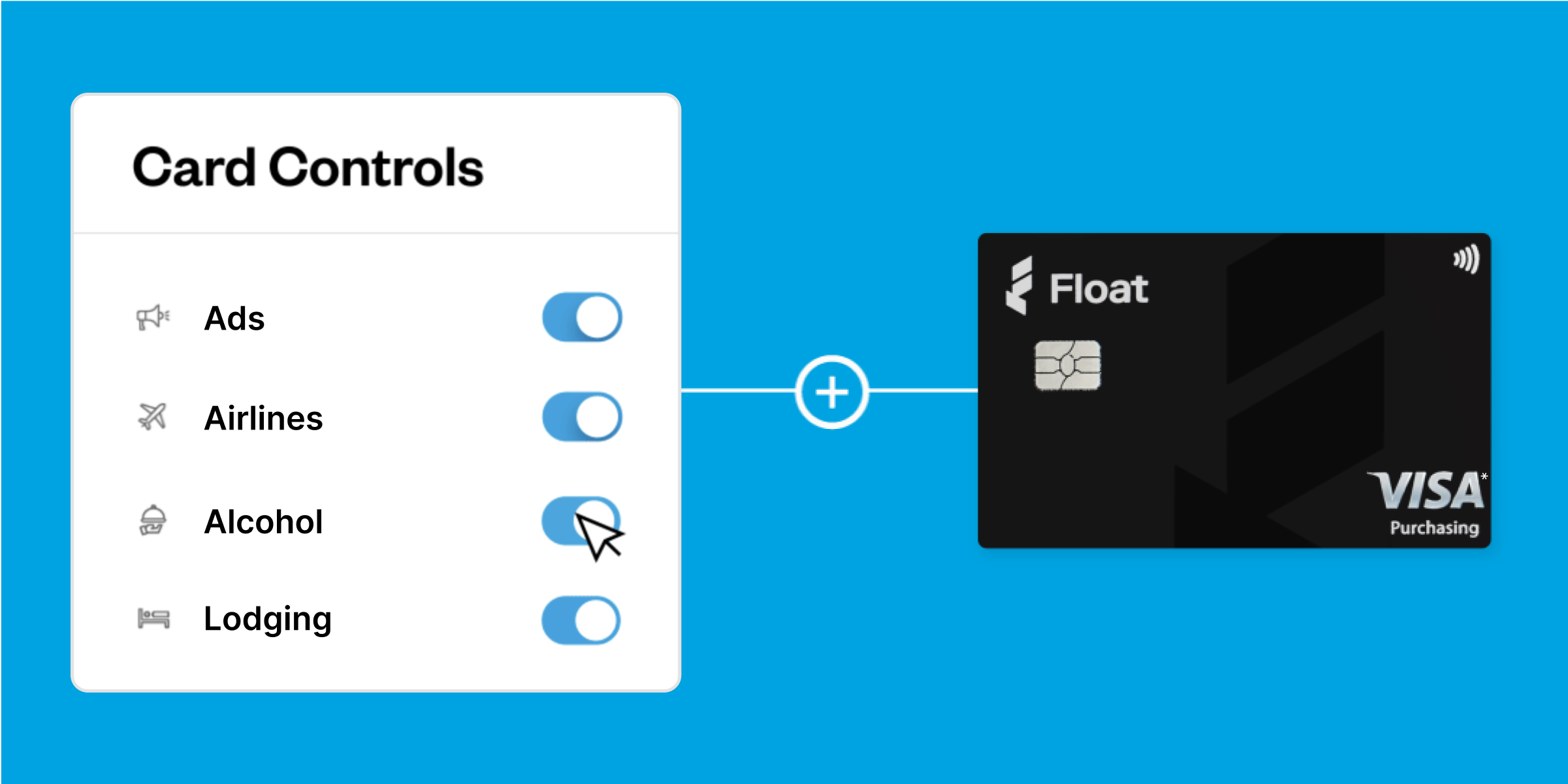

3 ways to automate spend management using our QBO feature

QBO manages your receipts better – with tax included

Float allows every employee to submit receipts via email, text or direct upload into the platform. Once a receipt enters the system, Float uses Optical Character Recognition (OCR) to pull the tax and tip off a receipt for easy and simple tracking. We know that some Canadian provinces have unique tax rules, and so we created this feature to accommodate multi-part tax codes and auto-recognize them every time a receipt is exported.

We know that so many SMEs and startups are using Quickbooks. That’s why our main goal is to easily integrate into every part of your work day so that managing your finances is a responsibility that’s easy, shared and simple to track.

To learn more about Float’s QBO integration feature, book a demo with us today!

Written by

All the resources

Financial Controls & Compliance

GST/HST Tracking in Canada: Why It Matters and How Float Simplifies the Process

If you’ve ever manually entered tax for each expense in your accounting software, you know how painful it is—especially when

Read More

Corporate Cards

How to Get Approved for a Virtual Corporate Card as a New Business (Without Hurting Your Credit Score)

Looking to add a virtual corporate card to your wallet without messing with your credit score? This guide is for

Read More

Corporate Cards

What Your CFO Wishes You Knew About Pre-Spend Controls

CFO Vinnie Recile shares what every business leader should know about pre-spend controls—a proactive approach to spotting and stopping risky

Read More