They say time is money. With Float, save both.

Rejoice over the financial control you’re craving so your company can save while it spends. Plus, enjoy straightforward perks you can actually use.

Approve spend before it happens

Most companies have a reactive approach to spending, filled with tracking down receipts and deciphering who spent what.

A proactive approach to spending using automated, multi-level workflows.

Send and approve spend requests with the click of a button, in both CAD and USD.

Best of all: no receipt chasing.

Float replaces:

Find hidden savings

It’s easy for subscription expenses to get out of hand without anyone noticing. Float provides custom insights designed to help you spend less.

Get notified about large increases in vendor spend so you can review to keep costs low.

Track duplicate subscriptions across teams to eliminate waste.

Take action to reduce costs and find efficiencies.

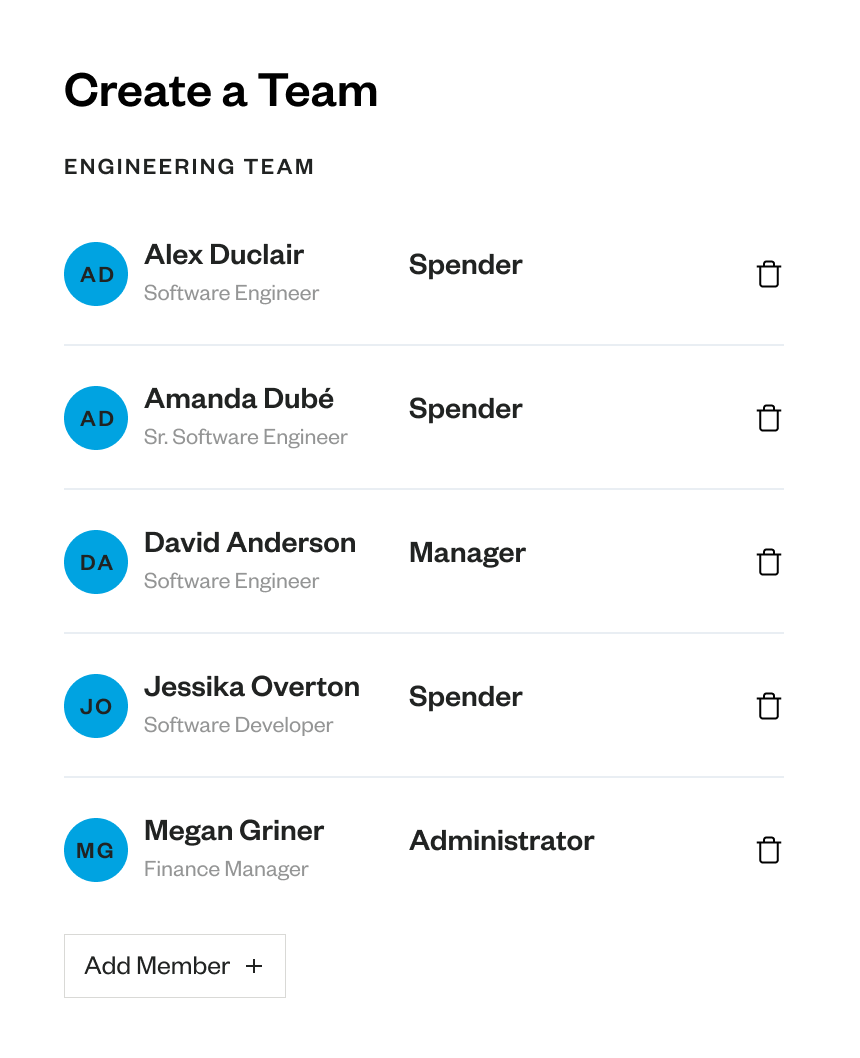

Still sharing corporate cards?

With Float, add as many users as you need at no extra cost, giving you better visibility into everyone’s spend.

️Create teams and assign roles to your company’s spenders for automated approvals.

Get unlimited * physical and virtual cards for employees, with no annual fees.

Eliminate card declines by assigning a budget to each vendor’s virtual card.

*Unlimited virtual cards. Unlimited physical cards are

available on Float’s Professional plan.

Save money

Plus, there’s perks.

Get up to $175k in partner savings by signing up with Float.

Business can sink or swim. Why not Float?

Your questions,

answered

Float is an easier, smarter way to manage your business spending. Think of it as a combination of no-personal-guarantee corporate cards and intelligent spend management software to help you automate, control, and manage your company’s spending.

Float customers have access to physical and virtual corporate cards in both USD and CAD. Once you issue cards to employees, Float will collect receipts after every transaction. Each transaction is then automatically coded and matched with its receipt, ready to export to your accounting software.

Just like a ‘regular’ corporate card, our cards are used around the world anywhere VISA and Mastercard are accepted. With accounts in both CAD and USD, it’s easy to switch between the two currencies when you need to.

Physical and virtual cards work essentially the same way! Virtual cards act the same way as physical cards, in that you can use them for any spend where you need to enter in a card number. Virtual cards can be created instantly whenever you need them, and are perfect for online expenses like recurring expenses or ad spends. Both virtual and physical cards are linked directly to Float software with individual card controls to help manage spend.

Float offers personalized payment terms based on your business’s stage of growth. With Float’s Pre-funded CAD and USD cards, your limits = your bank balance. You can connect multiple bank accounts in CAD or USD, and even set up automatic top-ups to ensure your cards never run out of funds. With Float’s Charge card (CAD and USD), you can apply for up to $1M in unsecured 30-day credit terms that you can automatically pay down throughout the month.