Automate your expenses

(you’ll thank us later).

Our intuitive software makes receipt collection and reconciliation easy. Close your books faster and save hours chasing paperwork at month end.

Less chasing, more automating

Waiting on employees for receipts? With Float, there’s no need for constant reminders or begging.

Team members are prompted to submit receipts via Slack, text, or email after each purchase.

Automatically match receipts to transactions and capture taxes, tip, and GL codes.

Export each transaction right to your accounting platform, in both CAD and USD.

Integrates with

One-click approvals make requesting spend easy

When employees have to email complicated spend requests, it wastes time and slows momentum.

Receive clear, simplified requests via Slack or email, removing overly complex approval forms.

Request and set up pre-approved spend by team, category, and amount.

Free up managers’ time and give your employees an easier way to request and manage budgets.

Approve and request spend in

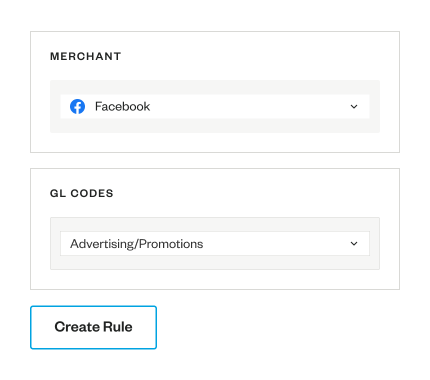

Close books faster with transaction rules

Repeat vendors and transactions taking up a ton of time?

Import your chart of accounts and create rules for common vendor transactions.

Assign vendor names, GL codes, and tax codes.

Save time at month-end and cut down on human error.

Business can sink or swim. Why not Float?

Your questions,

answered

Float is an easier, smarter way to manage your business spending. Think of it as a combination of no-personal-guarantee corporate cards and intelligent spend management software to help you automate, control, and manage your company’s spending.

Float customers have access to physical and virtual corporate cards in both USD and CAD. Once you issue cards to employees, Float will collect receipts after every transaction. Each transaction is then automatically coded and matched with its receipt, ready to export to your accounting software.

Just like a ‘regular’ corporate card, our cards are used around the world anywhere VISA and Mastercard are accepted. With accounts in both CAD and USD, it’s easy to switch between the two currencies when you need to.

Physical and virtual cards work essentially the same way! Virtual cards act the same way as physical cards, in that you can use them for any spend where you need to enter in a card number. Virtual cards can be created instantly whenever you need them, and are perfect for online expenses like recurring expenses or ad spends. Both virtual and physical cards are linked directly to Float software with individual card controls to help manage spend.

Float offers personalized payment terms based on your business’s stage of growth. With Float’s Pre-funded CAD and USD cards, your limits = your bank balance. You can connect multiple bank accounts in CAD or USD, and even set up automatic top-ups to ensure your cards never run out of funds. With Float’s Charge card (CAD and USD), you can apply for up to $1M in unsecured 30-day credit terms that you can automatically pay down throughout the month.