Better business spending for Canadian finance teams

Corporate cards, expense software, and earnings that are anything but a bank.

Business spending as it should be.

Say goodbye to the old way of managing spend.

Welcome to the Float way.

Float’s smart corporate cards allow you to spend, track, approve, and reconcile all your CAD and USD expenses in one simple to use platform.

Avoid fees on USD spending and give your business the ultimate financial control, no matter the currency.

Float’s physical and virtual cards are backed by customized spend controls and real-time reporting to help you manage your company spend. Even better? Instant reminders to easily text, email, or upload receipts as soon as a purchase is made.

With unlimited virtual cards for every vendor and employee, keep control by only adding funds when needed. Then set limits, pause, or cancel whenever you want to keep unapproved spends at bay.

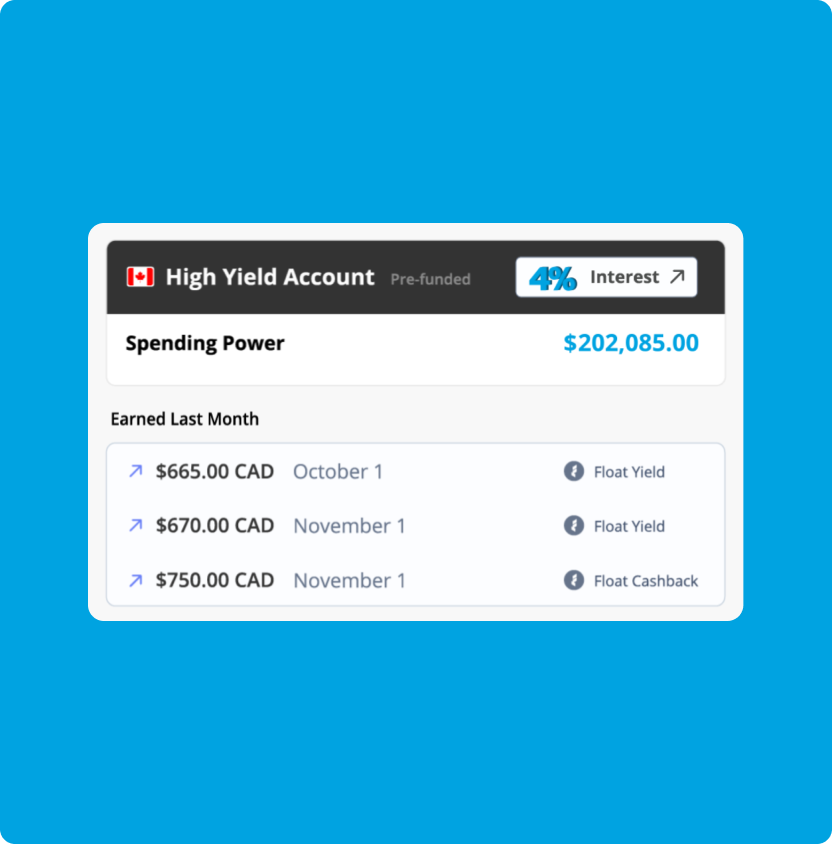

Earn 4% on your cash balance in both CAD and USD.

With rates up to 2.7x the Canadian banks and no lockups on funds, Float Yield has the edge on traditional high interest savings accounts.

Every transaction made on a Float card gets embedded with receipts and automatically categorized with GL codes, tax codes, vendors, and more, based on your company’s unique Chart of Accounts.

Direct integrations with Quickbooks, Xero, and NetSuite make month-end a breeze. Float also supports popular accounting tools like Sage and Microsoft Dynamics with CSV exports.

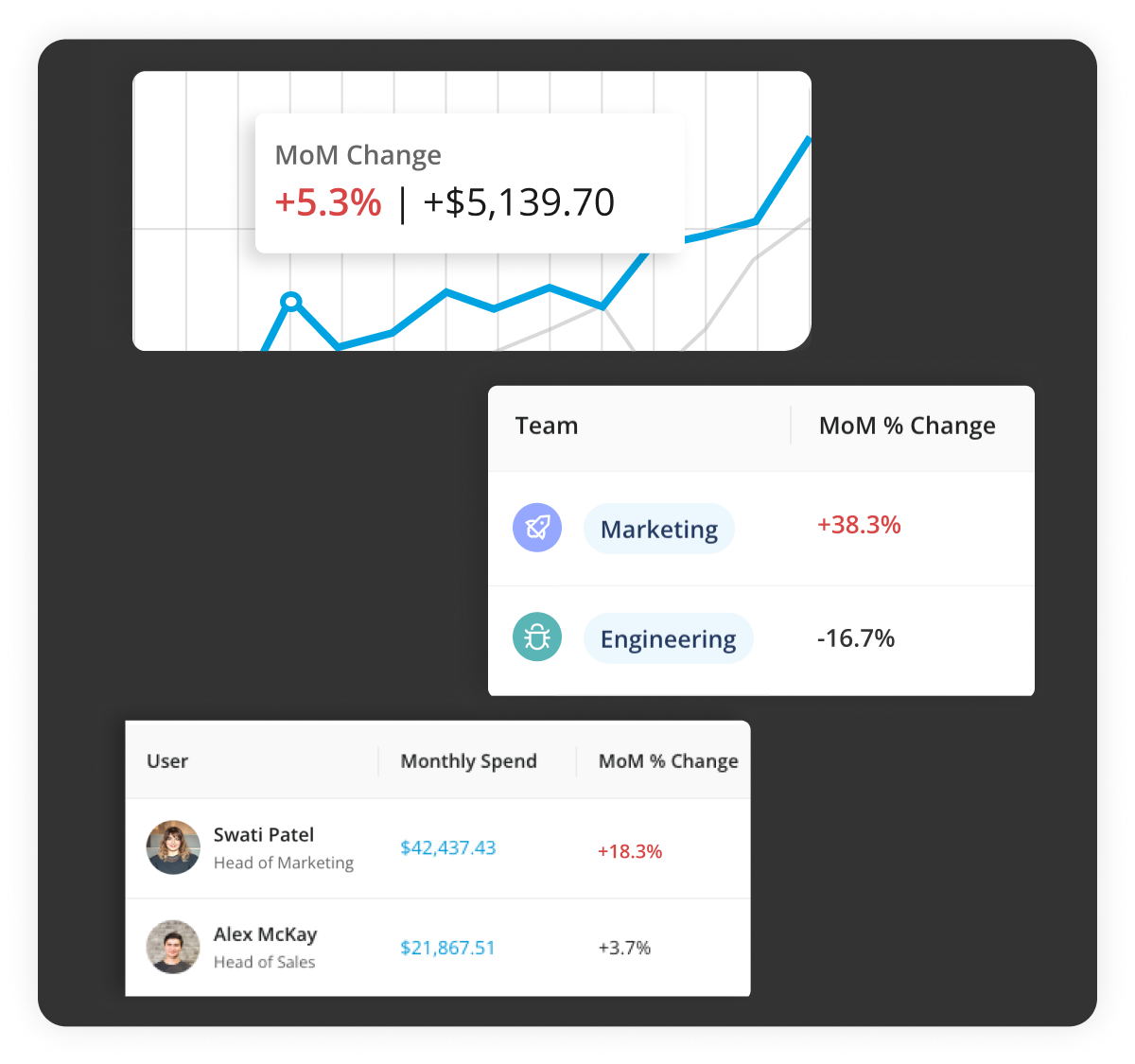

Float gives you the ability to react quickly to changes in spending patterns and market trends with real-time Reporting.

Spot anomalies before it’s too late, dig deep into spend patterns, and find savings with all your company spending in one platform.

Trusted by 1,000s of leading Canadian companies.†

See How Float Works

Float is how modern companies automate their spending while retaining control, so you can focus on what matters.

Float replaces

Most things in

finance aren’t fast.

Our customer support is.

Our team is ready to help.

Fast, friendly support is just a click away.

💬 Available when you need us via phone, text, chat and email.

“It gives us greater control because we’re able to monitor company spending, easily approve purchase requests, and Float reminds employees to submit their receipts on time. ”

Adrian Pape

VP Finance

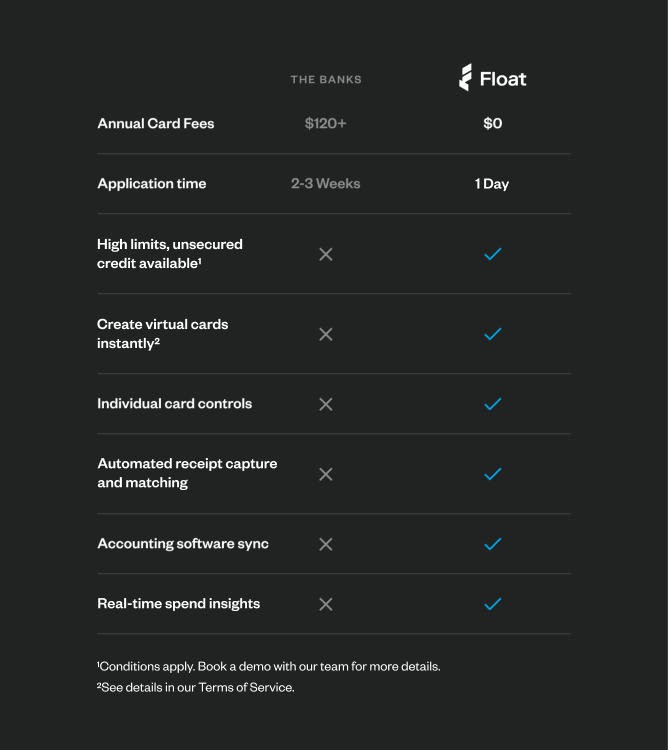

Businesses have evolved.

Banks haven’t.

Fast-growing businesses need more flexibility and cashflow than banks can offer. With Float, get the spend you need when you need it, with smart corporate cards, time-saving software, and no hidden charges.

Retained Learnings

Not ready to try Float? Stay in touch by subscribing to Float’s monthly publication for Canada’s finance leaders.

Get the goods with relevant insights

It’s only required reading if you’re looking to level up your business knowledge. Check out our assortment of financial tidbits and case studies to see how Float can make things easier for your business.

Case Studies

How BenchSci Saved 40+ Hours a Month Streamlining Spend Management with Float

Trailblazing AI firm, BenchSci shares why they chose Float for secure spend management at scale.

Read More

Case Studies

Health and Wellness SaaS Company Practice Better Closes the Books 6x Faster with Float

How the growing startup Practice Better leveraged Float to bring their spend management and bookkeeping in-house.

Read More

Case Studies

Creative Production Company Makers Chooses Float to Scale Spend Management

Makers shares how they cut their time spent reconciling transactions in half while empowering spend across the company’s project teams.

Read More